There are many ways to achieve financial independence. One of those ways is through frugality. Some degree of frugality must be exercised in any action plan towards financial independence, but the degree can vary drastically. The following is 6 suggestions on what to give up on your journey to financial independence. I believe these 6 things will make a big difference in not only speeding up the process but improving your life in some way.

The 6 things to give up if you want financial independence are:

- Over sized houses

- New cars

- Convenience foods

- Cable TV

- New Clothing

- Gifts.

Disclaimer: You don’t have to give up these things in order to reach financial independence, but I see these as wallet drainers that do not add any real value to your life. Giving them up or optimizing them will help tremendously on your way to financial independence. This is taking a frugal approach (also known as badassity) to reaching financial independence.

Jump Ahead To:

Oversized Houses

Housing is probably your biggest expenses, it is for most people, and it is part of the big 3 expenses. In fact, the first three things on this list are part of the big 3 expenses. I like talking about the big 3 because they probably make up anywhere from 50%-70% of your spending and you might not even realize it. I talk more about the big 3 expenses in detail here.

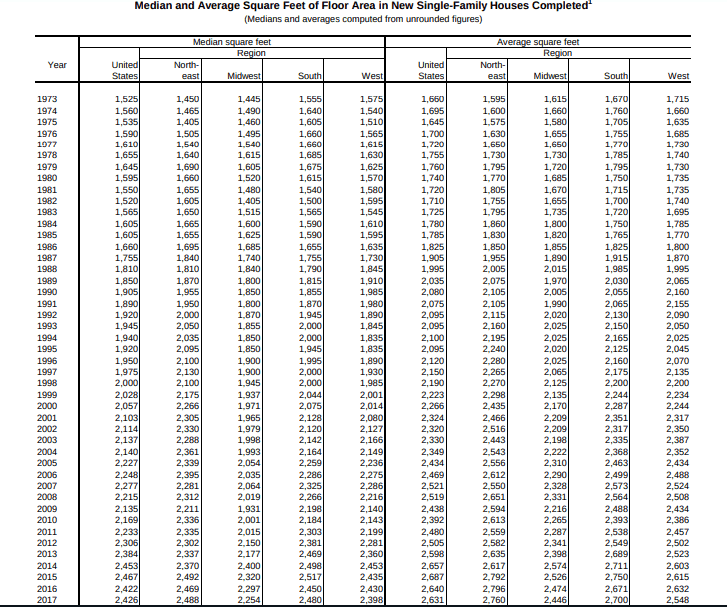

Isn’t it funny how new houses are being built bigger and bigger than ever before? Much bigger than the average family growth rate and we aren’t getting that much taller either. In fact, According to this document on pg 345 from Census.gov the median square foot for new single-family homes being built in 1973 was 1,525 square feet in the United States. For 2017 that number has risen to 2,426 square feet.

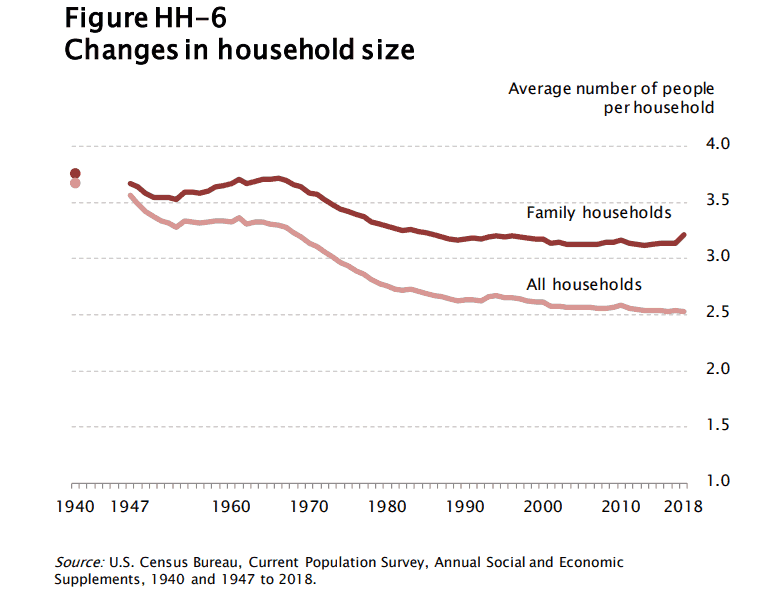

In 44 years the median home size of newly built single-family homes has risen by 901 square feet. That is also a 59% increase in size. Has the average family increase in size by 59% in size from 1973 to 2017? I think not. In fact, the average family size has declined from 1973 to 2017. Census.gov data shows that in 1972 the average number of people per household was 3.01 while more recently in 2017 that number has fallen to 2.54. Yes, there is just over 2 and a half people per household now.

So what gives? Why do we need all of this space all of a sudden? The answer is we don’t. Not only is the size of houses increasing and the size of the household decreasing, but our housing prices are increasing along with it. After all, it cost more to build a bigger house, maintain a bigger house, heat a bigger house, cool a bigger house, etc. That is why “giving up” oversize houses is first on the list. Downsizing is a simple and effective way to slash your biggest expense.

I can’t say for certain why our houses are becoming so large and our families shrinking but it looks to me like a case of “keeping up with the Joneses” You don’t need to keep up with anyone, you need to surpass them. Go against the grain, if everyone else is going it then you probably shouldn’t be. Let’s get out of the rat race together and keep our house sizes appropriate.

New Cars

So now that we have dealt with the largest expense we can move onto what is most likely the second largest expense we have; transportation. Besides going carless altogether the next best thing we can do is avoid buying new and expensive cars in the first place. Besides the initial price sticker, there are much more costs associated with cars such as maintenance, fuel, insurance, taxes, registration, repairs, etc.

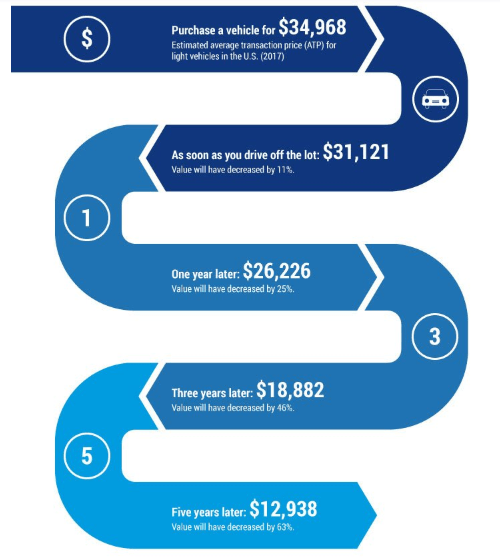

The problem with new cars starts with massive depreciation. Depreciation is basically how fast you lose the money you spent to buy it. With new cars that number can be scary. It will depend on the kind of car and how good of condition you keep it in, but there are general figures we can use to estimate how much a vehicle loses due to depreciation. According to CarFax, the first year is approximately 20% then about 10% per year until year 5 where it may have depreciated as much as 60% and therefore be worth only 40% of its original value.

That is insane, and if that doesn’t scare you then I do not know what will. The loss is bigger the more expensive the car originally was. A 5-year-old car purchased for $50,000 would now be worth about $20,000 or a $30,000 loss. That is $6,000 lost per year just to depreciation. That is the sweet spot for me, I would love to buy a new-to-me car for 60% off! If the car is just 5 years old then it probably only had one owner too! Trusted Choice Insurance has a great graphic to represent depreciation:

There is more to it than just depreciation too. A new car will cost more to register, it will cost more in sales tax, it will cost more to insure, and a bunch of other things. You simply won’t come out on top if you buy new and expensive cars. Don’t even consider leasing because the math is simply not in your favor there at all. Cars are expensive modes of transportation, that is something we have to live with if we choose to drive them. Can we agree that their purpose is to get us from point A to point B and nothing more?

Convenience Foods

Convenience in almost all respects is going to cost more than something inconvenient, that’s for sure. As number 3 of the big 3 expenses, food is not something we should be looking for convenience in. These kinds of foods can have a misleading price as well. One serving of a frozen meal may just be $1 and seem like a low-cost meal, but oftentimes you can make several similar meals with better taste and more nutrition for a fraction of the cost.

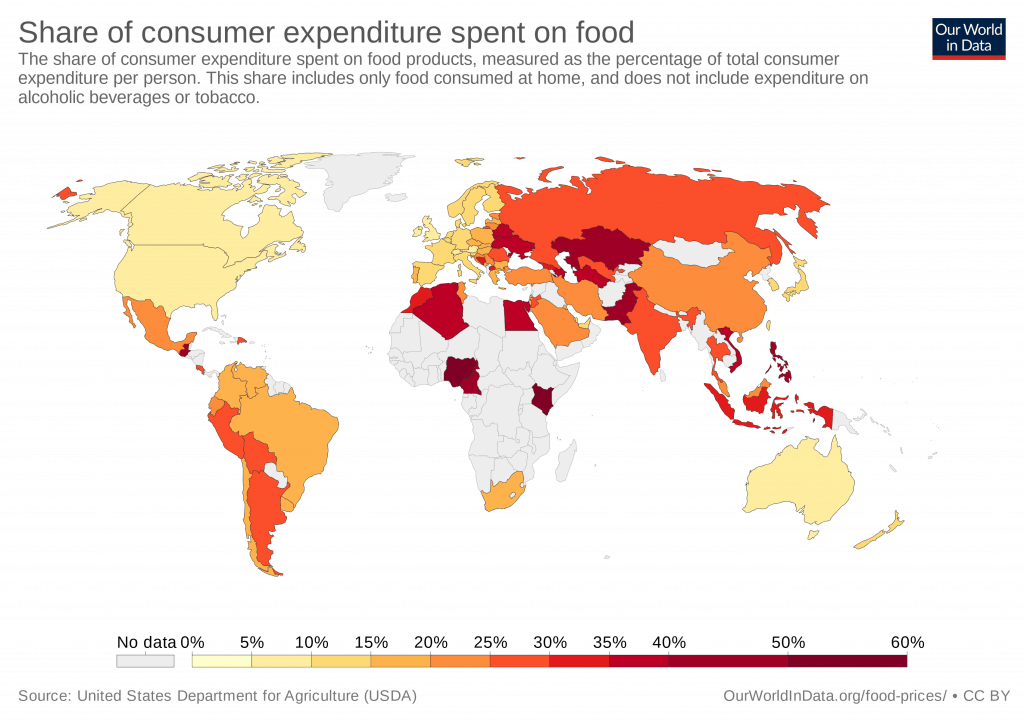

In the United States, we enjoy very low food prices, yet our grocery bills are $1,000 a month? How is this possible? I think it has a lot to do with the kind of foods we are buying. The price of prepackaged foods may seem like a good economical deal on the surface, but in reality, we are paying top dollar for very little nutrition and serving sizes. If it only needs to be microwaved then odds are that you overpaid.

Not even including things like eating out (which is rarely a good idea for your wallet) convenient foods in supermarkets are priced accordingly. Cook a majority of your own food and buy things in larger quantities for lower per unit prices. If you usually buy a 2-pound package of chicken for $2.99 per pound, just look nearby for the 10-pound packages that are $1.99 per pound. I see this at literally every major grocery store I have ever been to. Sure you will pay $20 today instead of $6 but you can freeze the chicken you do not use for later. If you buy 10 pounds of chicken over the course of the month in 2-pound packages it would have cost you $30 instead of $20.

You can buy a majority of your foods in large bulk batches. Anything that has a long shelf life or that can be frozen. Buying larger units in batches not only saves you on a per unit basis, but it can reduce the number of trips to the grocery store. You probably shouldn’t be going there more than once a week at least. The same idea goes for individually packaged portions. Make your own portions. A box of 10 portion oatmeal cost a helluva lot more than a tub of old fashioned oats. This is just one small example, buy the most “inconvenient” packages and you can cut your grocery bill in half instantly.

Buy healthier foods too, it’s an unfortunate myth that healthy foods are more costly than nonhealthy foods, it was probably started by the companies that manufacture the processed convenient foods. Healthy food is cheap, especially if it is in season like with fruits and vegetables. Reducing your food costs can go a long way with simply switching to eating healthy inconvenient meals.

Cable TV

I would like to begin by saying, isn’t cable just an outdated expense? We have the internet now with so much better programming than cable has to offer. No one needs traditional cable anymore. I’m not saying subscription services are a good use of your time over cable, but at least services like Netflix and Hulu offer no commercials for a fraction of the price of regular cable. We also have an enormous video-sharing site known as Youtube. Our video entertainment needs are more than met without cable.

Beyond just the overinflated price of cable, watching too much TV is just a huge waste of time. I enjoy occasionally watching a new show or some videos on the internet, but I didn’t spend an average 3h 58min daily watching tv in 2017 like the average consumer. Most of what you get is advertisements anyway. Why do we pay $100 a month to have something like 30% of the time we spend watching be advertisements. It’s just not right. Cut the cord and find a hobby you enjoy doing. You can still watch most tv shows online for a fraction of the cost if you really wanted to. I bet you don’t really want to though because there are so many other things you could be doing.

New Clothing

Now, I’m not saying that you should go join a nudist colony and free yourself from the shackles of modern day clothing. What I mean by this is that we buy clothes much too often. Most of us have more clothes than we realistically need. How many clothing items are in your closet or in your drawers that you literally never use? Clothing can last a very long time so why aren’t we using them for as long as they last? Donating clothing is great, but do that with the clothing you never wear. Simplify your wardrobe and stop buying new clothes every week.

Shopping for clothing has become a hobby? How has this happened? You probably only need to shop for new clothes once a year tops. Buy some higher quality items and they will last a lot longer. I don’t necessarily advocate shopping at thrift stores for a majority of your clothing either. Premium quality clothing can be had for a good price, but just because it is at a good price does not mean that you need to buy it all the time. Use what you already have and free yourself from constantly being a walking advertisement of someone’s “brand”.

Gifts

Gifts are one of the biggest wastes of time in money in my opinion. Not all gifts, but most gifts. I bet most gifts end up not being used, probably re-gifted, returned, or put into the back of a storage shed. The intentions behind it are good, but the action is often unnecessary. If you must give a gift, give something that is actually useful or that has meaning behind it.

Most of the gift-giving holidays are propaganda derived from retail stores. Made up consumer holidays include but are not limited to; Valentine’s Day, Easter, Mothers Day, Fathers Day, Halloween, and Black Friday. They may have started out as something meaningful but what they have become is just unsightly. Now each and every one of them “requires” you to load up on certain products that are designed to represent these “holidays”.

Look past all the advertising and consumerism and celebrate in a different way. I am not saying to stop acknowledging any of these days, but bring out a new meaning in them. The best gift you can give is the gift of your time. Spend time with the people you love. The next best is probably money but stick primarily with the first one. Ignore the frenzy of advertising and junky products that quickly become forgotten as we move onto the next season. Don’t follow what everyone else is doing unless you want to be average. Becoming financially independent is being far from average.

Conclusion

Remember, the 6 things to give up for financial independence are Oversized houses, New cars, Convenience foods, Cable TV, New Clothing, and Gifts. Don’t actually look at them like you are “giving up” anything. Financial independence through frugality is not about sacrifice. It is about getting more of the things that actually have meaning and purpose to you and forgoing more of the things that have little meaning and purpose. Some of you might value one or more of these 6 things on a deeper level and that is okay. Know what brings you true value and surround yourself in excess of it, but also know what doesn’t actually bring you value and avoid it as much as possible.