When you first discover financial independence it can be a magical thing. Naturally, you will have a lot of questions. Hopefully, you can find the answers to those questions and more. I too have my own questions about FI all the time. Some questions you have might not have one single answer to them, some you have to ask yourself to determine if you are on track.

Here are 7 questions to ask yourself about financial independence when it comes to your own journey:

- Am I calculating my FI net worth correctly?

- Am I calculating my savings rate correctly?

- Does my FI plan cover health insurance?

- Should I tell others about my journey?

- Will I spend more when I have more free time in retirement?

- Will I be able to take the leap when I actually hit my FI number?

- Do I have a plan for after I reach FI?

I have attempted to put the simpler and easier to answer questions first but it is up to interpretation. I believe that these 7 questions are among the most important questions that you need to ask yourself about your journey. Some of them I cannot answer for you, only you have the answer. I do aim to hopefully guide you along the way to answer them yourself.

Jump Ahead To:

Am I calculating my FI net worth correctly?

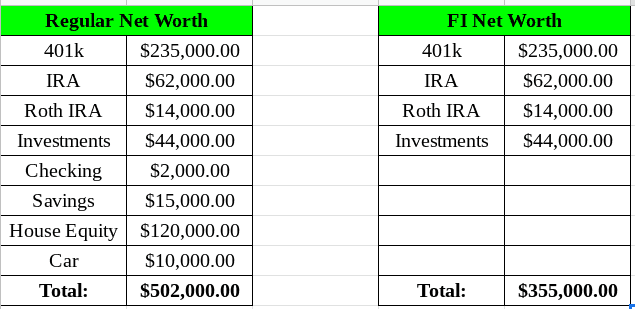

The first question I want you to ask yourself is if you are calculating your FI net worth correctly. This is important because your “FI net worth” is very different than your “regular net worth”. Ok, so what I mean by that is when you are calculating how much you have saved up for FIRE you don’t include everything of value like you do when calculating your net worth. It might sound obvious, but sometimes we get caught into adding the value of everything to our net worth because we want it to be as high as possible.

Don’t add everything to your FI net worth because not everything you own of value is going to be utilized in your withdrawal rate. For example, when you traditionally measure your net worth you include the money in your checking account, in your savings accounts, your emergency fund, the equity in your home, the value of your cars, and maybe the price of valuable possessions. With your FI net worth, none of this should be included. Why? Well because they do nothing for you when it comes to meeting your 4% withdrawal rule. You cant withdrawal 4% of your house every year, or 4% of your car. Your checking account isn’t giving you any real rate of return.

Only include your investments in your FI net worth. This will make your net worth smaller, but it is most honest when we are calculating our financial independence which I wrote extensively on in this article. Unless you are willing to sell your house today, your car today, or put your savings into investments, then they shouldn’t be included. What should be included in your calculation is your investment accounts, individual retirement accounts, 401k, etc. Another problem with including all that other stuff is that you don’t really know their true value until it is sold and you have the cash in hand. With an index fund, stock, bond, etc. you will know pretty much exactly how much you will get at any given point in time for how many shares. Here is an example below of how to differentiate your Fi net worth from your regular net worth:

Am I calculating my savings rate correctly?

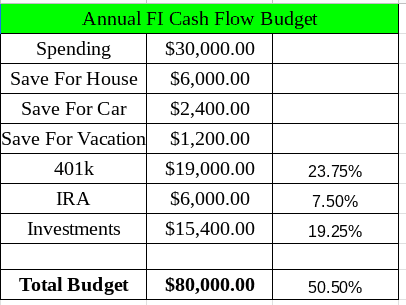

Along with calculating your net worth incorrectly, you could be calculating your savings rate incorrectly. I dislike the term “savings rate” when it comes to financial independence because it really isn’t savings. It’s investing. Your “investment rate” is really the thing that matters. Think about it, what are savings for? They are to be spent. Investments are there to work and grow. Never the less, savings rate is the commonly used term in financial independence. Anyway, your savings rate is what percentage of your take-home pay that you contribute to your investments for FI. The best savings rate is discussed by me in lots of detail in this article.

The mistakes happen when calculating the savings rate at times where you mistakenly include actual savings. Saving and investing are two totally different things. When you save you are accumulating a sum of money for a large expense. You are planning to spend that money. What do you save for? You save for a down payment on a house, you save for a car, you save for a vacation, etc. It is money that you plan on spending all at once at some time in the future. While saving is much better than spending something money you don’t have, it should not be included in your “savings rate” for financial independence.

Just like how only investment accounts should only be used in the calculation of your FI net worth; only money that you contribute to investment accounts should be included in calculating your FI savings rate. So just because you didn’t spend the money today does not mean it is included in your FI savings rate. Here is an example of a cash flow budget and what is included in the FI savings rate:

Does my FI plan cover health insurance?

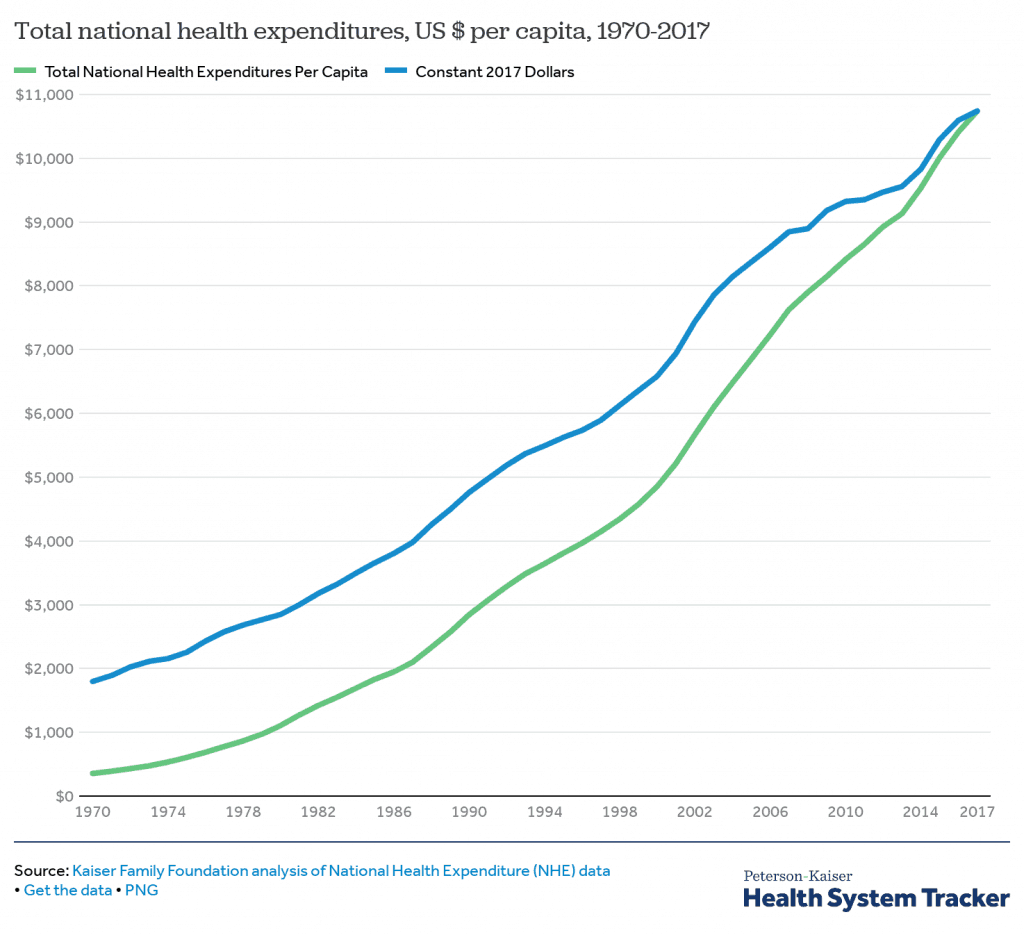

One of the biggest conundrums in the FIRE community is dealing with health insurance. Most of us have our health insurance subsidized by our employers, which makes it affordable for us. Once the employers are gone then we have to foot the bill completely on our own. Health care costs have risen dramatically in recent time in the United States. Healthcare costs spending has increased over 30-fold in the last four decades according to HealthSystemTracker.org So it is not a topic to be taken lightly, especially if we want to retire early from traditional work.

So while there is no doubt that it is an issue that we must all face, there are some options for us as early retirees. Everything is subject to change and therefore we must remain vigilant and be able to adapt to varying situations. If you worked for at least 10 years in the US and paid Medicare taxes (just like social security taxes) then you should be eligible for Medicare once you are age 65. The problem is that those of us seeking financial independence often “retire” from traditional work in our 30s, 40s, and 50s.

If you plan to FIRE really young Like I do in your 30s then that is 30+ years that you will have to deal with health insurance on your own. No matter how long you have until Medicare would kick in there are some paths you can take to cover your health insurance needs in early retirement. Luckily, dealing with health care coverage can be manageable for early retirees in most instances if the proper precautions are taken, here are a few ideas to deal with health insurance coverage in early retirement:

Veterans get VA healthcare

If you are a Veteran like me then you could be covered by VA healthcare. There are a few factors that determine how much you will pay when covered under VA health benefits like income level, a disability rating, and military service history. Still, using this system for your healthcare needs could be a very low-cost solution to this question.

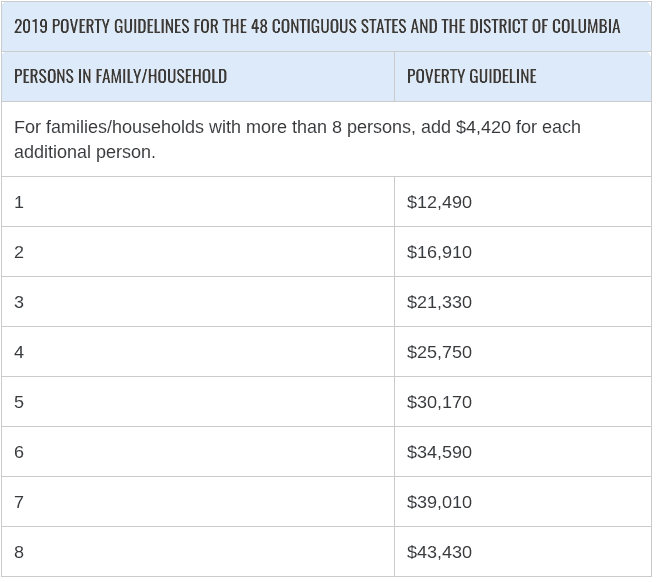

Subsidized coverage for Low income

If you become financially independent and are relatively frugal then you may qualify for subsidized coverage. HealthCare.gov is a great resource to explore this topic. It says that “In all states, your household income must be between 100% and 400% of the federal poverty level to qualify for a premium tax credit that can lower your insurance costs.” To put that into perspective, The U.S. Department of Health and Human Services HHS determined the following poverty guidelines in 2019:

Barista FIRE coverage

Another option for health care coverage for some is to still get it from an employer. Barista FIRE’ers are those of us that continue working in our early retirement. I discuss a lot about why you should keep working even when you reach financial independence in this article. The idea of Barista FIRE originates as working an easy part-time job as a Barista and getting full-time benefits. Working is an important part of like, it gives meaning. Sometimes we just want to escape their high stress, high work-load job and get into something simpler. Barista FIRE offers that opportunity. I have explained in detail what Barista FIRE really is in this article.

Self-employed coverage

Another option to explore if you are going to be working as self-employed or owning a business. Let the business pay for it. Still might be expensive, but it is a significant tax deduction for the business.

Should I tell others about my journey?

This question can mentally be the toughest because a lot of people don’t understand what FIRE is and how it is possible. When you try to explain it to them they might have a preconceived notion about it. Nevertheless, I believe that you should tell as many people as possible about FI because first of all, it will motivate you to stay on track and practice what you preach. Secondly, it helps spread awareness about what is possible. If you have no knowledge about what this movement is about then how can you support it.

You will get some funny looks, and there will be naysayers. In our consumer society, there are many people trapped on a never-ending treadmill. They think that it is impossible to get off of it. That treadmill is the rat race, and we know that there is a way out of it. It is also up to us to make more people aware of where the exit is.

Will I spend more when I have more free time in retirement?

An often fearful question that arises is if you will naturally spend more money with more free time. Any rational human being that has extreme time constraints from full-time work would be reasonable to think so. The real answer is usually no. The opposite is usually true for traditional retirees. Most people see significant reductions in spending with age, and although you might be retiring young, the same could still apply to you with less spending even with more free time.

An often forgotten fact when you become FI is that you may have significantly fewer costs just because you don’t have a regular job anymore. Commuting costs, in particular, are very expensive, especially if you drive a long roundtrip distance to work. Professional clothing can be another large cost of employment. Eating out for lunch adds another big chunk of expenses, especially since it can be a “social requirement” in the work environment.

However, you could choose to spend more when the time to retire early does come. If you plan on spending more than you do now in order to occupy your time and pursue other interests then that is fine, the only thing to keep in mind is to base your estimated annual spending in retirement on the 4% safe withdrawal rule. I talk about calculating your FI number in great detail in this article.

Will I be able to take the leap when I actually hit my FI number?

Here’s a scary thought that comes to the mind of many people that are close to achieving financial independence: Will I be able to do it? There must be a strong motivation to actually call it quits and go your separate way from your regular employer. Leaving the familiar and joining the unknown can be a scary thing in life. I’m sure we have all experienced it at one time or another in some kind of situation. The same goes for when you actually reach your FI number. Are you ready to pursue your post FI life? If not then you might not have a good reason. Which is why you need to ask yourself this next question…

Do I have a plan for after I reach FI?

Just as important is it to have a plan along the way to reaching FI, it is just as important to have a plan for after you reach your number. This is where it is completely up to you. This one will take some soul searching, but it is one hundred percent important. This is known as having something to retire to, not just something to retire from. Now whether that be raising kids, traveling, starting a business, continuing to work, volunteering, whatever. You must decide what you want to do once you reach financial independence.

Not having at least an idea of what to do after you reach FI will be a disaster. It will leave you with a “now what?” feeling that could spiral into a depressing dark hole of binge-watching tv and eating bonbons on the couch. Maybe it won’t end up that bad, but you will be bored, and you won’t have a purpose. We all need to have some kind of purpose, some kind of meaning in our lives. Without that we are nothing. Don’t make the mistake of not having a plan for after you reach your FI number.

Conclusion

You will develop a lot of questions along your FIRE journey, its normal. These 7 questions are some of what I believe to be very important for you to have the answer to. We might not always have the answer to every question that comes up, but that is part of what keeps life interesting.