Financial Independence and Retire Early is a statement that goes together very well. However, they are two separate statements themselves. Being financially independent and being retired has some major differences that need to be addressed.

The 9 major differences between financial independence and retirement are:

- You don’t have to stop working when you are financially independent

- Reliance on social security is not a component of financial independence

- You don’t have to wait very long to become financially independent

- Pensions are not the primary driver of financial independence, but they are helpful

- Financial independence is not mainstream, but retirement is

- Retirement is easier than financial independence

- Age is mostly irrelevant in financial independence

- Financial independence is much more within your control than retirement is

- Achieving financial independence forces you to adapt and overcome

Understanding these differences is key to setting the right goal for yourself and your family. You can become financially independent and not retire. You can retire and not be financially independent. Retirement in the traditional sense varies dramatically to what those of us that seek to become financially independent need to do.

Jump Ahead To:

1. You don’t have to stop working when you are financially independent

While there are many definitions that the word “retirement” can fit, I think that it is safe to say that “the action or fact of leaving one’s job and ceasing to work.” is probably the most commonly known and most widely accepted. Financial independence and retire early go together very well but you can have one without the other.

If you finally reach your goal of financial independence, why do you must cease to work, especially if you enjoy your work in the first place? Financial independence is an opportunity to achieve happiness. It’s an opportunity that you must work hard to achieve, but when you are there you can do almost anything.

One of those things you can do is quit your job. Or you could work fewer hours. You could even switch careers completely. That’s the point, your options are nearly limitless because you don’t have to work for money. The work you do now is for reasons other than money. If you are working for some reason other than money then you can bet that it is something that you get value from or else you wouldn’t be doing it.

Retirement, on the other hand, is traditionally thought of as never working a job again. You are retired, been there and done that. Unfortunately, it has historically been because someone was too old to even continue to work and produce. Thankfully, nowadays we are living much longer and can enjoy even decently lengthy traditional retirements. When you become financially independent you could cease to work forever as well. That is the definition anyway. You have found a way to never need to be reliant on a paycheck again. Whether or not you take that offer is a different story.

Financial independence is about choices and freedom. Having your choices mostly un-dictated by the need to work for green paper is the biggest draw of financial independence. However, the freedom to still work because you want to is another example of how powerful FIRE is.

2. Reliance on social security is not a component of financial independence

When we as a society envision retirement and when it is time to retire we undoubtedly think of social security (and medicare to go along with it). If you were born in 1960 or later then you are going to have to wait until age 67 to reach “full retirement age” according to OPM.gov.

Of course, you don’t have to wait that long to start utilizing social security. You may start withdrawing social security at a reduced rate starting at age 62. Sometimes that is the smart thing to do, and sometimes it’s better to wait. However, when planning on early financial independence, social security should not be included in your calculations.

This is because social security benefits are completely out of your control. Instead, the funds are controlled by the federal government. They aren’t exactly the best at managing money as we know. I’m not saying that the social security program will become insolvent and cease to exist, it’s just that we have no idea what the future of the program will look like.

This is especially true if you are young and want to retire very early such as in your 30s or 40s. At that point in your life, you still have 25-35 years until you can expect any kind of social security benefits. So when it comes to social security, do not include it in your FIRE planning. If you do end up receiving benefits in the future then take it as a wonderful surprise.

3. You don’t have to wait very long to become financially independent

Whereas the Social Security Administration (SSA) defines the normal retirement age for people born after 1960 to be 67 years old, those of us in the financial independence, retire early space are planning on becoming retired many years before we reach that age. Sometimes we plan on retiring as many as 30-40 years earlier.

If you are the average young person, the last thing on your mind is retirement because it is a time frame so far away. If you are on the path to financial independence then you realize that you have more options than society would traditionally have you believe. Early retirement is possible. There are many examples of successful individuals and couples that have done it, and there are even more people that are working towards it.

The point is that there is no one timeframe for retirement. Traditional retirement knowledge would assume that a 27-year-old would still have a 40-year long career ahead of them before retiring. Financial independence challenges this by saying that 27-year-old starting from scratch could retire in 10 short years if they make smart choices by building their wealth exponentially, creating passive income streams, or some combination of the two.

4. Pensions are not the primary driver of financial independence, but they are helpful

More often than not, a traditional retiree relies on a pension to fund the majority of their retirement. Pensions are paid for by companies (or governments) to former employees that have worked for them for a long time. Social Security is pretty much like a pension for everyone regardless of where they work.

Pensions are becoming less and less commonplace in the workforce, and so modern-day workers are now more responsible than ever for funding their retirement. This isn’t a problem for most people seeking to become financially independent and retire early. The FIRE crowd typically does not rely on pensions to fund their early retirements. There are many reasons for this.

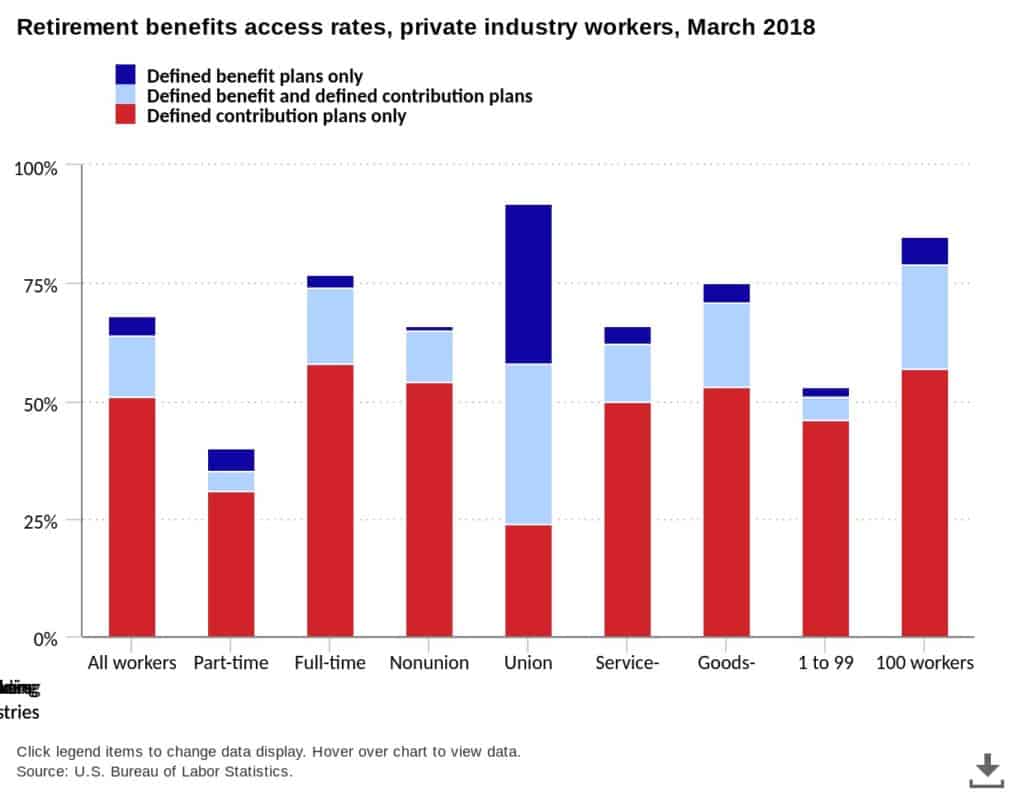

According to the Bureau of Labor Statistics (BLS.gov) “In March 2018, 51 percent of private industry workers had access to only defined contribution retirement plans (401(k)s, etc) through their employer. An additional 13 percent had access to both defined benefit and defined contribution retirement plans at their workplace, while 4 percent of private industry workers had access to only defined benefit retirement plans. (Pensions, etc)”

Of course, a reliable income stream is never a bad thing, but sometimes spending 30 years of your life to earn it is not an ideal situation for those of us seeking to become financially independent and retire early. Yes, some pensions such as military pensions “only” take 20 years to earn, but even 20 years of your life is a large price to pay, especially if the work is somewhere that you do not enjoy your life.

No doubt seeking a pension can be a viable option for many people wanting to retire with financial security, including those seeking FIRE. However, receiving a pension is often not calculated or required to become financially independent. Patient and diligent investing is often the primary driver to becoming financially independent, especially in today’s career fields where pensions are becoming rarer and rarer.

5. Financial independence is not mainstream, but retirement is

Everyone knows what retirement is and what it means in our society. It’s probably most people’s ultimate goal in life…However, the FIRE community is extremely small comparatively. Not that many people know what it means to become financially independent. It just isn’t mainstream news or common thought. I’d be willing to bet that if more people knew that it was possible, then more people would be willing to work towards financial independence.

We live today in a strong consumer society. In fact, in the United States, the Gross Domestic Product (GDP) is about 68% of household consumption. The Bureau of Labor Statistics (BLS) estimates that by 2022, personal consumption will account for about 70.5 percent of nominal U.S GDP. It’s easy to conclude that we like to spend a lot of money in the United States. Achieving financial independence takes discipline to turn that around and save and invest a large portion of your income instead of spending it.

Part of the problem is the stigma associated with becoming financially independent. Some people don’t understand why we seek this goal. Some think that it is selfish and lazy to acquire enough wealth to leave the workforce. Other’s think that we are being a cheapskate and stingy because we are smart with where we funnel our cash flows. At the end of the day, FIRE is just not as popular as traditional retirement, and it faces many unique criticisms.

6. Retirement is easier than financial independence

Think about the level of difficulty it takes to obtain both goals. For people seeking to retire at normal retirement age, they have it a lot easier than those of us wanting to retire early by becoming financially independent. Retirement has a lot longer of a timeframe and so you don’t have to save as much, and you don’t have to invest as much to earn a higher rate of return.

Timeframe

Someone beginning at age 30 with the goal of becoming financially independent in 15 years vs retiring at the normal retirement age of 67 will have different time frames to accomplish those goals. The 30-year old who wants to retire by 45 has 15 years to become financially independent, and the 30-year old that wants to just retire at 67 has 37 years to accomplish this. Let’s say that both of them want to spend $3,500 per month in today’s dollars when they reach their retirement.

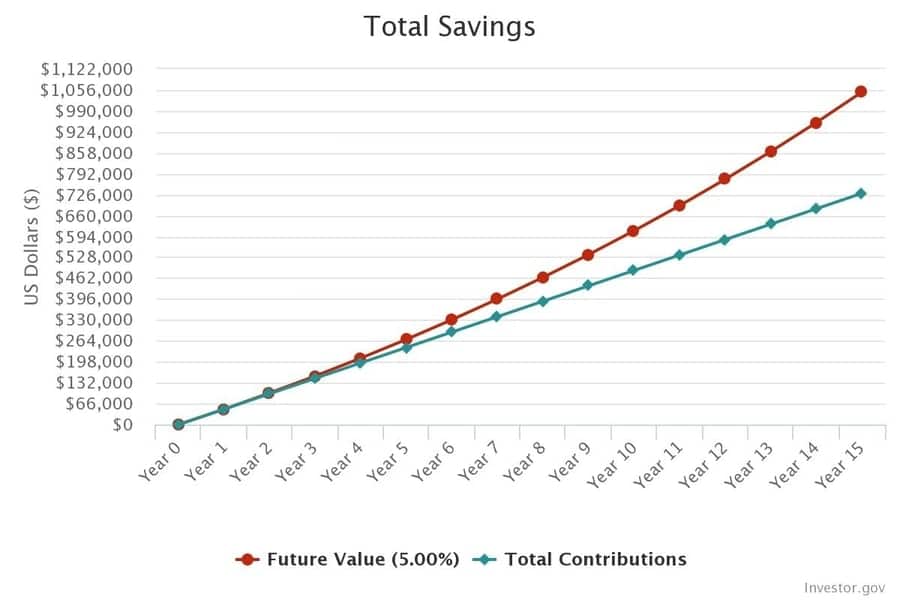

If we assume that both of them will earn an average rate of return of 8% on their investment portfolio and experience an average inflation rate of 3% then they would be making a real return of 5%. How much does each need to save per month to retire at their goal ages?

FIRE in 15 years

The 30-year old that wants to become financially independent by age 45 has their work cut out for them. It is not impossible, but it is difficult. If the individual wants to spend $3,500 per month then that would equate to $42,000 annually. Using the 4% safe withdrawal rule we can multiply the annual spending by 25 to calculate their financial independence number. ($42,000 x 25 = $1,050,000). To achieve a net worth of $1,050,000 (in today’s dollars, so the total amount will be more) in 15 years starting from zero, earning a 5% real return, they would need to invest approximately $4,055 per month.

They would have contributed $729,900 over those 15 years. The money would be worth approximately $1,050,012.90 when accounting for a 3% inflation rate. Adding back that 3% inflation rate would mean the absolute value of the investments would be about $1,321,221.86 (use 8% return instead of 5%).

Normal Retirement in 37 years

You will see that a 30-year old that requires the same level of spending but at age 67 will have a much easier time. If we can count on social security, the average monthly benefit was $1,474.77 per month in October 2019 or $17,697.24 annually. However, I won’t even include estimated social security benefits because anything can happen or change in 37 years.

So, if this 30-year old wants to retire at age 67, they have 37 years to save up for an inflation-adjusted amount of $1,050,000. Using the same estimation of starting from zero and earning a 5% average real return they would need to invest about $861 per month. Doing so would result in about $1,050,021.93 (adjusted for inflation). If we don’t account for a 3% inflation rate and the return is calculated as 8% then the actual dollar amount of investments would be about $2,098,122.54.They would have contributed only $382,284 of their own money while compound interest would have made the remainder possible.

So as you can see, by pretty much anyone’s definition investing $861 per month is easier to accomplish than investing $4,055 per month for most people. That is why traditional retirement is easier than early financial independence because you have a longer time frame horizon to let compound interest work for you, and therefore you would need to contribute less to your investments.

7. Age is mostly irrelevant in financial independence

While there are “normal retirement” ages set forth by various government entities such as the Social Security Administration and the Internal Revenue Service. There is no set age for when to become financially independent. You can achieve financial independence at practically any age if you are classifying it using the 4% safe withdrawal rule. There are many paths that you can take to become financially independent, here are 7 of them that I wrote about.

Some paths will take longer than others, some will require more effort, and some more luck, but the bottom line is that anyone can do it with enough patience, dedication, and hard work. There is no waiting until you reach a magical age to retire when you take it into your own hands. While it is great to have a goal age in mind when you want to become financially independent, the age you succeed is mostly irrelevant.

8. Financial independence is much more within your control than retirement is

To become financially independent, one must take their life into their own hands. There is not outer reliance on someone else or some other entity. Being FI is arguably one of the ultimate ways to be independent. It is a goal and a milestone that no one will hold your hand and walk you to. Plenty of people have the opportunity to become financially independent, but seldom few actually will achieve it in their lifetime. You must take control and create your destiny. FIRE will likely not just fall into your lap, it is like a fence built one brick at a time.

9. Achieving financial independence forces you to adapt and overcome

No one cares about you becoming financially independent except for you. How you are working towards financial independence will determine what kind of obstacles you will face. With such a great goal, comes many great challenges that lie ahead. It’s not easy, to begin with, and you can bet that life is going to throw some curveballs at you. Financial independence forces you to overcome those curveballs if you are truly in it till the end.