One of the best things you can do for your financial independence (FI) journey is to move somewhere where the cost of living is less so that your money can stretch further. Los Angeles is not one of those places. Is it even possible to reach financial independence in Los Angeles for the average person? Of course, it is possible for a select few, but what about everyone else? I have often wondered if it is possible to reach financial independence in Los Angeles (LA). LA experiences one of the highest costs of living in the country.

So, how do you reach financial independence in Los Angeles? If you want to reach financial independence in Los Angeles it is going to take an extremely frugal lifestyle because of the below average median income and the high cost of living.

What I want to do is evaluate realistic expectations on how to reach FI in LA. I need to evaluate things like the cost of housing, the median income, and other general costs. The idea of reaching FI is the same, we would need to invest a large portion of our income over a set amount of years until we are projected to reach 25x our annual expenses in investments. Is a high level of investments possible in LA? Let’s find out.

Jump Ahead To:

The goal of FI

Just as a quick recap of what I want to define as financial independence: You reach a point where your investments (usually in index funds) are worth 25x what you spend annually. This allows you to follow the 4% safe withdrawal rule and live off of 4% of your assets for essentially the remainder of your life.

Keep in mind that I will be coming at this with a very frugal mindset, especially for being in Los Angeles. LA is generally just an expensive place to live, but if you come at it with a frugal mindset I believe you can live there on a modest level of spending. It would require a very optimized lifestyle, but it can be done and many people live on much less than what I will be projecting.

I will also be using a married couple with no children in my example. It is easier, in my opinion, to reach financial independence as a couple because there are tax benefits and there are two incomes. The primary expenses do not increase as much as the possible income increase because the housing is shared, food can be purchased in bulk, etc.

The median income in Los Angeles

According to Census.gov the median household income in Los Angeles was $54,501 in 2017. Which is actually a pretty sad statistic since the United States median household income was $61,372 in 2017! Yes, that is right, the median income in the very high cost of living area in the city of Los Angeles is less than the overall United States.

What makes that particular statistic kind of scary is the cost of living factor associated with each. For the United States, the cost of living index is averaged to be 100. By comparison, the LA cost of living index is 195.1 according to BestPlaces.net What this essentially means is that it costs 95.1% more to live in LA than it does on average in the USA. So not only is the median income a little bit less, but the cost of living is almost double!

We can see already that achieving financial independence is going to be very difficult in a place like LA for the average person. To make matters worse, median household income “includes the income of the householder and all other individuals 15 years old and over in the household, whether they are related to the householder or not.” So this means that everyone living in one housing unit is included in the median income. The median income does not come from only the head of household.

So for our example, we shall be using the $54,501 median household income to include the dual income of two adults. We will make things a little bit easier for ourselves and round up to $55,000 in annual income and pretend like it is net income (or take-home pay). The reality is that household income is actually based on gross pay (income before taxes and deductions) which means that the actual take-home pay could be much less!

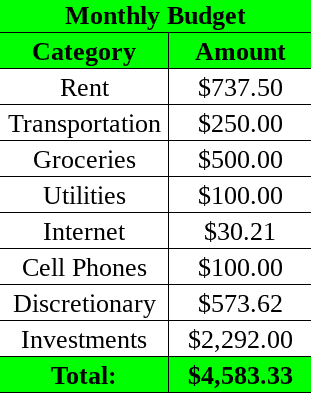

I will give the benefit of the doubt and divide $55,000 in take-home income per year by 12 months and now we have $4,583.33 to worth with every month. Oh, and just in case you need a quick refresher on what the “median” is; it is the middle number of all numbers in a data set. It is useful for statistics like income because it eliminates outliers (those unusual people who make extraordinarily low or high incomes). It also means that half of all households make above that figure and half of all households make below that figure.

The median rent in Los Angeles

Probably the biggest obstacle to face in Los Angeles is the high cost of housing. We won’t even consider buying in Los Angeles because the cost of renting will usually come out on top in a high cost of living city like LA. It also gives you the mobility to move and make reaching FI much easier. But for now, we will use the median rent in LA to estimate our expenses.

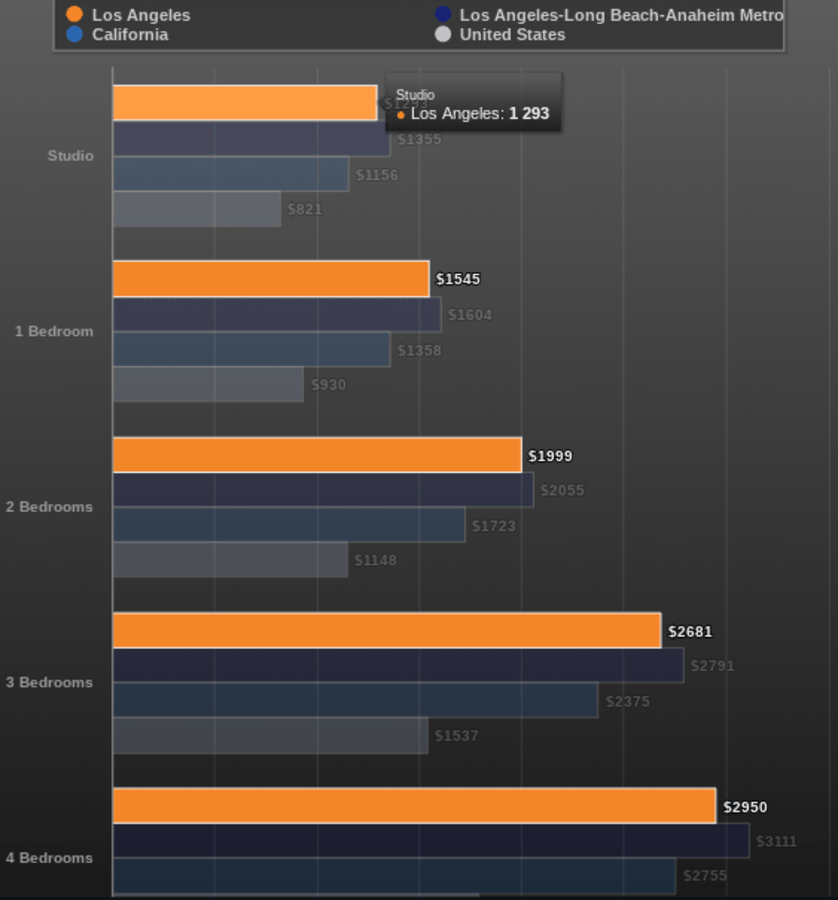

According to Census.gov the median gross rent in Los Angeles City, California is a measly $1,302. This statistic seemed unusually low for me so I sought out another source. BestPlaces.net puts the average rent in Los Angeles as follows:

- Studio: $1,293

- 1 bedroom: $1,545

- 2 bedroom: $1,999

- 3 bedroom: $2,681

- 4 bedroom: $2,950

As a couple with no children, you would think that they could comfortably opt for a studio or 1 bedroom and pay the lower price right? But with a frugal mind, they can get an even better deal. What if they spit a 2 bedroom with another couple? What if they split a 3 bedroom with other people? How about a 4 bedroom? Assuming that everyone pays the rent based on bedroom occupancy the roommate idea quickly becomes a better deal than a studio or 1 bedroom. The new monthly rent cost for our couple would be as follows:

- Studio: $1,293

- 1 bedroom: $1,545

- 2 bedroom: $999.50 ($1,999 / 2)

- 3 bedroom: $893.66 ($2,681 / 3)

- 4 bedroom: $737.50 ($2,950 / 4)

As you can see going with roommates in Los Angeles would pay off nicely. Sharing a 4 bedroom home would cost less than half for our couple compared to renting a 1 bedroom apartment on their own. It certainly is a big lifestyle choice to make, but if financial independence in Los Angeles is the goal then it sharing a 4 bedroom house seems to be the most optimal and so that is what I will use for our budget.

The general cost of living in Los Angeles

We now know that the cost of living index for LA is 195.1, which is almost double the average of 100 in the United States. Groceries are right about average at 100.4, Utilities are below average at 93.7, but transportation is at a whopping 190.7.

Transportation

Transportation is usually the second largest expense after housing for most people. I talk about the big 3 expenses in this article. For LA it is particularly pricey. It is a large city known to have not so good public transportation. It does make it difficult to go carless, which means greater transportation expenses. Our couple will be living close to their jobs and will make public transportation work. Since chose to live very close to work, they are able to walk, bike, take the bus, or use rideshare services. This keeps their transportation costs down dramatically.

The metro website says that a basic 30-day pass will set you back $100. That isn’t exactly low cost for public transit but it is much better than the average cost to own a vehicle. The average cost to own a vehicle is $9,576 per year according to BLS.gov. Dividing that by 12 months we have an average monthly cost of $798. This is a very high figure because it included the purchase, gas, oil, taxes, insurance, maintenance, etc. What’s worse is it is supposed to be the average. LA’s transportation costs are well above average and so the cost of car ownership there would be above average as well.

We will be using the metro public transportation system in order to cut costs, and living close to work helps a lot too. Our metaphorical couple will then pay $200 per month for transportation with metro 30 day passes. $50 will also be added for miscellaneous ride sharing usage within the city.

Food

Next up is number 3 in the big 3 expenses; food. Luckily, food doesn’t have to cost a fortune if you shop for the right things. LA has an average cost for groceries so that helps. The secret costs of food become very apparent when you include things like restaurants and fast food. Getting your meals from these sources can cost you so much more than getting groceries.

Our couple does not budget money for restaurants and fast food, all of their food budget is directed towards groceries. They purchase foods in season, on sale, and primarily eat staples like oats, potatoes, rice, etc. They also purchase in bulk quantities in order to avoid frequent trips to the grocery store and only go once a week tops. Their food budget for the two of them is at a healthy $500 and that includes necessities like toilet paper, paper towels, laundry detergent, etc.

Even though they eat a majority of their food at home, cook, and bring lunch to work, they do eat out on occasion. However, they do not have a pre-planned budget for restaurants and fast food. Instead, they treat it as entertainment and it comes out of their discretionary spending.

Utilities

The cost of utilities in LA is slightly below average. As we already know, our frugal couple is sharing a 4 bedroom house and so they are able to split not only the rent but the utilities as well. Numbeo.com puts the basic average monthly utilities for a 915 square foot apartment in LA at $143.80. It might be safe to assume a 4 bedroom house being twice as large in square footage or 1,830 square feet. So we can double the average monthly utility costs to $287.60. However, we can then divided that by 4 based on occupancy to get a cost of $71.90. In order to account for a possibly larger house and increased utility usage based on household size, we can round up to $100 per room.

Internet

Numbeo puts the average monthly cost at $60.43 for internet expenses. With a larger household, you will need faster internet due to more usage. If we double the cost (and the speed) then that is $120.86 per month. Split between 4 bedrooms that is $30.21 per month.

Cell Phones

This can be a very large expense if you let it get out of hand. Today though there are many plans you can get at a decent price. It is the brand new phones that really tack onto the high monthly costs of cell phone bills. If you don’t get the newest phone every year then you can keep your bill relatively low. We will estimate $100 per month for the two. You should be able to get unlimited everything at this price. If you can get on a family plan then you can reduce costs per person even further.

Discretionary (Everything else)

Hard to say how much to spend here, it is totally dependent. For the most part, this amount of spending is purely up to you. I will budget $573.62 because it leaves us with $2,292 for investments. Very convenient on my part because $2,292 is approximately 50% of the take-home monthly income. 50% is a good investment rate for financial independence. At this level of savings, you should theoretically reach FI in about 17 years if you start from zero. Although it is not the best savings rate for FI like I talk about in this article, I would consider 50% a good goal to shoot for because it gives you a working career below 20 years, which ain’t too bad.

Los Angeles Financial Independence Budget

I prefer to keep things as simple as possible. In order to do that I believe that making your budget with as few categories as possible will benefit you the most. This makes things much easier to manage and track. You can use personal finance software like Personal Capital to keep track of all your spending categories just like I do. The fewer categories you use, the easier it is to manage your budget. Here is the full budget for our metaphorical couple attempting to reach financial independence in Los Angeles:

Things to keep in mind

Who’s to say if things would work out in this hypothetical situation. There are many variables that could apply that maybe I don’t know about, or maybe that average and median statistics cannot show. Sure, with this budget, theoretically, someone could achieve a 50% savings rate in LA. Would it be worth it though?

The lifestyle that you would have to live in order to achieve this savings rate in an area like LA is very extreme. In order to meet the requirements, our couple would have to share a 4 bedroom house with at least 3 other people. For some, it is no problem, or easy when you are young, but there is always going to be tension in a crowded household. What if they lose a roommate or someone doesn’t pay up? The bills still have to be paid. There are a lot of things that could arise from sharing a large household. The savings are definitely there, the question is if someone can live that a lifestyle for 17 years while trying to achieve FI?

The couple would also have no car in order to save money on transportation. The metro passes could probably get them anywhere they want to go in LA…eventually. The city is not known for efficiency when it comes to public transport. It can make life a bit frustrating not having a car, but the cost savings are definitely there, especially in a place like LA.

The same goes for utilities and internet as it does with the rent. Everything is being shared by a larger household and everyone is then able to capitalize on the savings, but who is to say that everything will go according to plan every month. So this razor tight LA budget depends on a perfect scenario. There are flaws in every budget estimate, but I took the best data I could find and applied a frugal mindset to it with FI as the primary goal.

Conclusion

It is possible to reach financial independence in LA on median income, but your lifestyle would not be all too ideal. For a 50% savings rate, you would need to share housing, have no cars, eat out very sparingly, etc. It would be difficult, but not impossible. If you manage to get through all that and still choose to stay in Los Angeles then your living situation would not improve even while financially independent. The numbers just don’t work out too good for a decent lifestyle in LA. The cost of living is almost double the national average plus the median household income is slightly below the national average. Both of those factors do not play well with financial independence.