I am here to tell you that financial independence is not just something for high-income earners. I believe financial independence is possible for anyone. If your making minimum wage then it might be a lot more difficult for you than for someone making above median income, but it is still possible. It might take a little longer, but it is possible…Notice a trend? Frugality is your friend if you are making minimum wage, and I believe it could eventually get you to financial independence.

Financial independence is possible on minimum wage, but it’s not going to be easy in the slightest. You would have to be 100% on top of your budget and carefully scrutinize every aspect of your cash flow. You need to make a rock-solid budget and stick to it no matter what, it would take tons of sacrifice and probably isn’t viable for most people, but the point is that I think it is possible in theory, but not ideal at all. The good news is that no one has to stay on minimum wage forever, there are always other viable alternatives, even with little work experience.

Jump Ahead To:

Tracking Cash Flow On Minimum Wage

Our cash flow is essentially where the money comes in and where it goes out. To start out, I will assume that you are working a full-time schedule of 40 hours per week with 52 weeks in a year so 2,080 hours in the year. (40 x 52 = 2,080) The federal minimum wage in 2019 is $7.25 per hour and has been since 2009. Luckily, most states have adopted their own minimum wage to be above that figure.

To make things fair, I won’t be using the federal minimum wage. I will be using an average minimum wage of all 50 States in the U.S. I took all 50 of the 2019 state minimum wages and divided it by 50 to get an average of $8.73 per hour. I only used the “large company” minimum wages from the states, and I rounded the figure up from 8.7258 to 8.73.

So we take our average minimum wage of $8.73 and multiply it by 2,080 hours to find our gross annual income ($8.73 x 2,080 = $18,158.4) Unfortunately, you don’t take home the entire $18,158.40 because even on minimum wage there are taxes to be paid.

There are many deductions that could be taken from your minimum wage paycheck but the mandatory deductions are usually FICA (Social Security and Medicare) and Income taxes. For minimum wage, I will assume that you do not have any income taxes withheld because with such a low income and the retirement contributions you will be making for financial independence, you shouldn’t have a tax bill. You can actually elect for this legally if your tax liability is expected to be zero. I won’t go into details on that here, but you can claim exemption from withholding.

FICA taxes, on the other hand, are shared 50/50 by the employer and the employee. In 2019 FICA taxes totaled 15.3% (12.4% for Social Security, and 2.9% for Medicare). You only have half of this withheld from your paycheck which is 7.65% (12.4 / 2 = 7.65). Taking this into account we have to deduct the FICA taxes from our gross pay to find our net pay of $16,769.28 ($18,158.4 x 7.65% = $1,389.12) => ($18,158.4 – $1,389.12 = $16,769.28)

Just in case the math was hard to follow in paragraph format, I am going to lay it all out here:

$8.73 (Average U.S. State minimum wage)

x2,080 (Work hours in a 52 week year, while working 40 hours each week)

=$18,158.40 (Annual gross pay, before any taxes or deductions)

–$1,389.12 (FICA taxes of 7.65% of gross pay deducted)

=$16,769.28 (Annual net pay, or annual take-home pay)

÷12 (months in a year)

=$1,397.44 (Net monthly pay, or monthly take-home pay)

So there we have it. We have $1,397.44 to work with every month and we want financial independence. How are we going to do it on such a low number? The answer lies in having a rock-solid budget and living an optimized lifestyle. It is also important to note that there might be subsidies for low-income individuals, but I won’t be taking any of those into account.

Having A Rock Solid Budget With An Optimized Lifestyle

Here is where the fun really begins; the budget. If you want financial independence and you are on minimum wage, then your budget needs to be awesome. The budget needs to be sealed perfectly and not have any leaks. What I mean by that is you need to know exactly where every penny of your money goes.

To start off, I will assume no debt, because lenders typically want someone with more income to lend money to. If you do have debt then it needs to be paid off as quickly as possible. Instead of contributing to financial independence, the new cash flow will be funneled directly into paying off debt, starting with the highest interest rates on down. You won’t be taking on ANY debt on your path to financial independence while on minimum wage because all of the debt you qualify for will not be any benefit to you.

Secondly, you will establish an emergency fund of at least 3 months of living expenses, but preferably closer to 6 months of living expenses because minimum wage jobs are usually the first jobs to disappear in a recession, or when a company is not doing so well. Instead of contributing to financial independence, you will be funneling money into this emergency savings until you reach 6 months of living expenses because it will protect you from losing your job and/or an unexpected large expense.

Housing will be your biggest expense, it’s usually the biggest expense for everyone. In order to keep it at a minimum, you will be living with a roommate or roommates. Make sure it is legal in the housing you are staying at because the last thing you want is to violate a lease and someone loses a security deposit or there is a lawsuit filed against you. You could potentially find a long term room for rent in someone’s house where you only pay a flat fee to have access to the room, a bathroom, and the kitchen. I think this would be ideal because there really aren’t any surprises in your monthly housing expense. I will use $500 per month cost. I think this is reasonable depending on the area you are living in. If you are on minimum wage then you can’t really complain. The $500 per month includes utilities so that is all you pay.

Transportation is usually the next largest expense that everyone has, but guess what? It won’t be yours. When you are on minimum wage, you need to make some sacrifices and get your priorities straight. You don’t need a car. If you already have a car, then sell it off because cars are expensive. Not only initially, but every single month they drain money out of you. You will strategically live close to where you work so that you can walk there. Or better yet you will get a good used bike to ride. This will essentially make your transportation expenses close to zero. If you need to get somewhere further then you will learn the local bus schedule, train schedule, or other low-cost public transportation options. I will budget $50 per month for the odd use of public transportation or ride-sharing.

Food comes in third, which will be the next largest expense after housing. There are lots of people that spend more on food every month then you will be spending on housing! You will eat smartly, and you won’t sacrifice eating healthy to do it. Right off the bat, there is no eating out at restaurants or at fast food joints. The cost of that kind of food is well beyond what you will pay at the grocery store and not worth it on your income level. You will exclusively cook all of your own food. You won’t buy very much meat unless it is marked down for a really good price. You will drink tap water only. The majority of your calories will come from staple carbs such as rice, potatoes, oats, pasta, etc. These foods can be bought in bulk and provide a lot of calories per $1 spent. For nutrients, you will be getting fruits and vegetables that are in season and very low cost. You will also shop for your necessities at the grocery store and buy a generic brand. You can easily spend less than $200 per month on all of this.

Everything else I consider discretionary expenses (they are optional). Hopefully, the room you are renting includes internet access, but if not then your local library has it for free. $0 per month for internet. You do not need a smartphone, it is a luxury item. You might need a phone and pay as you go service, but you do not need unlimited everything, this should cost no more than $25 per month for cell phone. No one needs to buy clothing every single month. Clothing is not a monthly expense. if you need clothing then get it at the thrift store or a yard sale…except maybe socks and underwear. $0 per month for clothing. Learn to live without cable, it is one of the most out of date expenses I can think of, there is so much free video entertainment online, with fewer commercials. $0 per month for cable.

The best things in life really are free. Your entertainment will be free such as reading, online videos, walking, hiking, running, parks, community events, online games, board games, seeing friends, seeing family, cooking, museums, yoga, meditation, etc. The list goes on…and there are many more activities that are extremely low cost. For this, I will budget $100 in extra discretionary spending for whatever you feel like that month. Also, another $100 per month for general savings for irregular expenses or very occasional larger splurges.

Lets put it all together because it is easy to get lost in the paragraphs:

$1,397.44 (Monthly take-home pay)

–$500 (Housing: renting a room in someone’s house, utilities included.)

–$50 (Transportation: No car, mainly walking/biking with some public transport.)

–$200 (Food/Necessities: No eating out, low cost but healthy groceries only.)

–$0 (Internet: Included in housing, or free at your local library)

–$25 (Cell Phone: No smartphones, pay as you go plan)

–$0 (Clothing: No one needs to buy clothes every single month)

–$0 (Cable: Out of date expense, plenty of free videos online)

–$100 (Entertainment: It is discretionary, anything that you want to use it for)

-$100 (Savings: General for irregular or larger expenses)

=$422.44 (This is for financial independence)

This would be an investment savings rate of 30.2% which is pretty substantial. Is this kind of budget sustainable? Maybe…but it really depends. I think I could do it for a while if I had to but it’s not ideal for sure. That is why your next goal will be to increase your income. As you can see, you can reduce your expenses down to a very low level.

What about health insurance? Like I said in the beginning, there are subsidies available for low-income individuals, health insurance is usually one of them. Also, there are many minimum wage jobs at large corporations that offer health insurance benefits. It’s too complicated to compute for this simple illustration because the price will vastly differ. I’ll admit that I personally am pretty lucky here because I do get health insurance covered by the Veterans Administration basically for free.

Earning More Money

Now that you are living well below your means, you want to increase your means as much as possible. This will make your lifestyle more enjoyable and make financial independence easier and faster. This does not mean that you will inflate your lifestyle at the same rate that your income increases. Your goal here is to still increase your savings rate to at least 50% over time because that is one of the basic goals of FIRE.

One way to increase your income could be to spend your free time learning new skills, or new knowledge. This is an investment in yourself that could lead to increased earnings in the future. I don’t just mean expensive college classes either, there is so much information out there today that is available for free. YouTube especially has so many videos filled with knowledge provided for free by others. Your options really are endless to improving your skills and knowledge online. So, you should learn some new skills that employers want and it could help improve your income.

Start a “side hustle” or a side job. The options for side income have exploded with the internet and the sharing economy. Do a Google search for ways to make a side income and you will be bombarded with ideas, one or two of which could be right for you. Some side income ideas have potential to earn money today, some in a week, or some could take a long time. Find one you think you would enjoy because you will be spending your free time doing it and you don’t want to be miserable.

Get promoted at work. Where you work now might have some openings available that pay more than minimum wage. If you are a good performer, then an internal hire is almost a no brainer. If you have been spending time learning new skills, then it could give you an even bigger advantage. Hiring is an expensive process, especially as the position becomes increasingly skillful. Hiring an internal employee such as yourself might make a lot of sense for the company, and you have plenty of references.

Make more money at your current job. Do you have the ability to earn tips at your job? If so then maybe upping your customer service skills could earn you some more money in the same amount of time. Does your job have any bonuses or incentive pay? If so then work on reaching those goals so that your per hour pay is more than the bare minimum. Some companies even offer “group” bonuses where if the entire group performs well at a certain standard, then everyone gets a bonus. Use that as motivation to keep everyone in check and motivated to reach that goal. Lastly, if the company has a 401(k) match, then contribute to it at least up to the match because that is 100% free money for you.

If all else fails you could switch to a different job. No one is stopping you, except maybe you. Look for other jobs while you are still working at your current job. It never hurts to reach higher than what you think you are eligible for because you never really know. Bottom line is that there are other opportunities out there for you to earn more than minimum wage, even if you have a small work experience timeline.

How Much Will I Need For Financial Independence?

Just like everyone else seeking financial independence, you will need at least 25x your annual expenses. In the first calculation, we figured our monthly expenses to total $975. ($1,397.44(monthly income) – $422.44(Investments) = $975) and to put that into annual expenses it would be $11,700 ($975 x 12 = $11,700). That is an extremely low figure that we said we wanted to increase that spending a little in order to make life more enjoyable. Let’s say that by utilizing one or more of the “earn more money” ideas we were able to get to a 50% savings rate and to a $1,500 per month spending level.

Our new annual expenses would be ($1,500 x 12 = $18,000) $18,000 per year. That is still very frugal, but it would probably be a lot more enjoyable than $11,700. We multiply our $18,000 by 25 and we get $450,000 ($18,000 x 25 = $450,000) You need just $450,000 in investments in order to become financially independence on a $18,000 per year spending level.

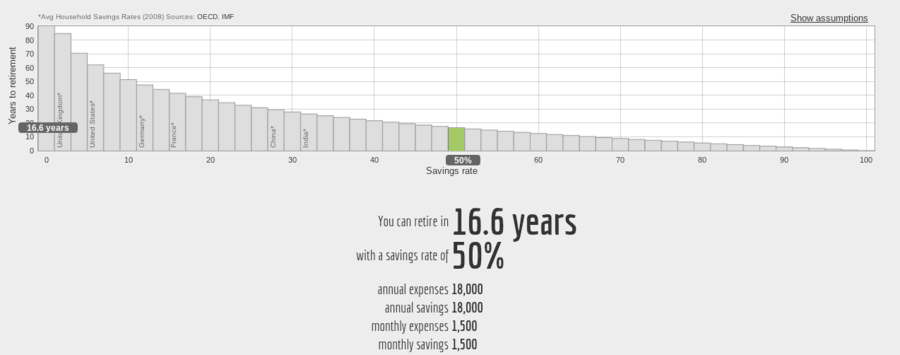

How long it will take will depend on a number of factors. For financial independence, it can be reasonably expected that if you are saving 50% of your income and maintain that same level of spending in retirement then you can retire in about 16.6 years. Here is a great visual calculator to play with:

Your situation could change, nothing really works out 100% as you first imagined it. You might want to increase your income further, or increase your expenses and have a more comfortable life, nothing wrong with that. Minimum wage is not forever, at least it doesn’t have to be. Although I think you technically could reach financial independence on minimum wage, why would you want to? Your situation will probably change and you can come back and re-evaluate where you are at and update your goal.

If you are on minimum wage right now, but dream of financial independence, I think you are already at a big advantage over someone who is a high earner and also gets into seeking financial independence. Why? Because usually if you are at a high-income level then you have probably built up a large number of liabilities and bills that need to be paid. Whereas if you are earning a low income, then your bills are relatively simple and smaller. You might have never had the experience of lifestyle inflation. Lifestyle inflation can be very detrimental to financial independence, so take pride in knowing that, and go get financially independent.

Conclusion

Financial independence is possible on minimum wage in theory, but it doesn’t seem like it would be very enjoyable at all. You can get started today seeking financial independence even if you are on minimum wage. Make a rock-solid budget and find ways to increase your income. Know what you need for financial independence and go after it. You will grow and adapt and so should your goals, but only you can make it happen.