“A million dollars isn’t what it used to be” is something I hear often. What it means is that the purchasing power of a million dollars goes further and further down in value every year thanks to inflation. The dilemma is often to question whether someone with one million dollars has enough to retire or be financially independent. It’s true, a million dollars definitely isn’t worth what it used to be. In fact, today we have more millionaires in the world than ever before. Is one million dollars enough to be financially independent?

The short answer is yes, having one million dollars is enough to be financially independent. You can receive a modest annual withdrawal from one million dollars and live pretty well in many places. Many people have become financially independent on much less than one million dollars. It is also worth noting that your one million dollars could grow beyond that even when you are retired.v

Jump Ahead To:

How Much Can You Spend Each Year On One Million Dollars?

If you know about financial independence, and retiring early (FIRE) then you know that it is commonly accepted that we like to utilize the 4% safe withdrawal rate. If you don’t know then basically it is a rule of thumb that says withdrawing 4% or less of your assets in “retirement” is safe enough to make your assets last practically forever. Applying the 4% rule to one million dollars gives us a safe withdrawal rate of $40,000 per year or less for spending ($1,000,000 x 4% = $40,000).

$40,000 can sound great to you, or it can sound a bit scary depending on where you live. If you are in most parts of Southern California, Near New York City, or any Island in Hawaii, then that level of spending may sound outrageously low to you. That was just a few examples, but if you choose to live somewhere else you will find that $40,000 isn’t all that bad. The cost of living of where you choose to live has a huge impact on your required retirement savings. So it is very important to take into account location when determining if one million dollars will be enough.

The median household income in the United States is somewhere around $50,000. Think about that, if you have $40,000 to live on then you will be just fine in most places. The figure is based on household income, which is the incomes of all who are residing in a particular household. The median wage earner isn’t exactly frugal either so they might feel like their spending doesn’t go very far. With financial independence, you will have a more optimized lifestyle where you will receive greater value from the $40,000 than most other people will. Besides, if you take away savings, retirement contributions, taxes, and work-related expenses then the median household is already at least on par with your $40,000 per year level of spending.

Many People Have Retired On Much Less Than One Million Dollars

Now that you know that you can spend up to $40,000 per year safely with a million dollars properly invested, there is even better news. Many people have become financially independent on less than a million dollars. It all boils down to frugality; the dictionary defines frugal as being “economical in use or expenditure” and “not wasteful”. It is amazing what adopting a frugal mindset can do for your finances.

You don’t have to be extremely frugal or “cheap” either. Simply not wasting money goes a long way. A frugal mindset is concerned with getting high quality and satisfaction for every dollar spent. Satisfaction from different things varies immensely from person to person. For example, I value camping, hiking, and fishing so much that I am willing to spend a great deal of my budget on these activities, whereas someone that doesn’t like the outdoors as much would not receive the same satisfaction as I do.

Living on any amount of money in financial independence is all about utilizing the 4% safe withdrawal rule and applying it to any amount of assets that you wish to accrue. If someone plans to retire on $30,000 a year instead then they would need $750,000 in assets ($30,000 x 25 = $750,000). The reverse way of calculating the value of assets needed is by multiplying your planned annual spending by 25. It is the exact same thing as multiplying assets by 4% to find annual spending. ($750,000 x 4% = $30,000)

Half of all people in the United States live on less than the median household income and most do just fine. I won’t even mention how much a majority of the rest of the world lives on. There are millions of people on minimum wage that get by every day as well, and some of them are happier than those making over 3x as much.

There are other options for retiring on less than a million dollars or less than your overall annual spending goal. There is no rule that you still can’t work when your financially independent or “retired”. You do however have many more options such as working only part-time, working in something you are passionate about, doing side hustles, being self-employed, starting a business, etc. A small subset of financial independence that has become popular is “barista FIRE” where you work a regular part-time job with full-time benefits. Barista FIRE could suit you well if you still want to work, but also want much more free time.

One Million Dollars Could Grow Bigger In Retirement

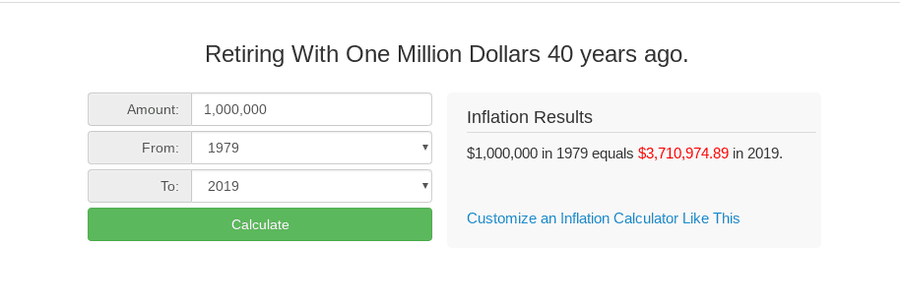

Every year, one million dollars will provide less and less purchasing power than the previous year thanks to inflation. It can be scary to think about, maybe one day everyone will be a millionaire because it will cost a million dollars to buy a cell phone. I don’t know, but neither does anyone else. What we can look at is the past to see how the value of one million dollars has changed:

As you can see, if you had become financially independent with one million dollars in 1979, it would be the equivalent of retiring on $3,710,974.89 in 2019. The 4% withdrawal rate is meant to cover inflation and your withdrawal rate. The average expected inflation rate in the U.S. is about 3% over a long period of time. So in theory, if you managed to make at least a 7% (4% withdrawal + 3% inflation) return on your investments then you would maintain the same amount of principal and purchasing power forever.

Inflation can be scary, but I don’t think it is as scary for those that are retired or financially independent than it is for everyone else. Why? Because we are a lot more flexible, especially with spending. The consumer price index (CPI) is the general measure of inflation that is supposed to represent spending patterns of the average American. We aren’t the average American, we are far from it, and much more flexible and conscious of our spending decisions. Inflation is not as scary to those who have financial independence or frugality on their mind.

With all of that said, you can become richer in retirement. If you take inflation, and your withdrawal rate into account and make more than an average 7% return on your investments, then guess what? Your assets grew faster than inflation and therefore they are worth more. The average return of the S&P 500 index since its inception in 1926 is about 10%. That would mean that your assets still grew by 3% over time when deducting withdrawals and inflation. It is like getting richer by just being rich…Maybe we’re on to something here.

Is One Million Dollars Enough For You?

I can’t decide if one million dollars would be enough for you to live on. I can tell you that it would safely yield $40,000 per year for spending. So you could ask yourself some questions to get a better understanding of whether one million might be enough.

Think about these 4 questions and answer them honestly to get started:

1. Does $40,000 (+/- $10,000) closely reflect your current level of annual spending?

2. your spending is higher than $40,000, could you lower it and still be comfortable?

Keep in mind:

- You won’t have commuting expenses.

- You won’t have work clothing expenses.

- You won’t have eating out for lunch at work expenses.

- You won’t have to go to happy hour to “de-stress” from work.

- You will pay less in taxes. (generally, investment income is taxed less)

- You could move to a lower cost of living area.

- You could downsize your home. (and downsize all the expenses associated)

- You could downsize to one vehicle between a couple.

- You could cut healthcare costs because of subsidies based on income.

- You could work part-time and/or on things you are passionate about.

3. Do you have something to retire to? How will you occupy your time?

4. Do you want to spend more when you are financially independent than you do now?

If you answer these questions honestly, they could point you in the direction of answering whether one million is enough for you. You should be able to gauge from the questions whether it is a positive or negative response towards retiring on one million dollars. Just keep in mind that your goals may change over time. That is okay, my goals sure have, and it’s actually a good thing because it shows that you are flexible, evolving, and adapting to whatever situation you are in now. I hope that I have shined some light on the subject for you. Just so you know, I could retire on one million dollars and be happy with it, but could you?

Conclusion

I believe that one million dollars is enough money to be financially independent and enough to retire on. If you utilize the 4% safe withdrawal rate then you would be able to spend up to $40,000 per year, which is a pretty good life in lower cost of living areas in the United States. Plenty of people have retired on less than one million dollars, mainly because of their frugalness, or by having other streams of income. While it is true that one million dollars will continue to be worth less and less over time due to inflation, your money can still grow in retirement. It’s up to you to decide if one million dollars is enough.