College is promoted heavily as a requirement if you want to “succeed” in life. Is college worth the “investment”? Today it is much more common to graduate from college with a negative net worth than it is a positive one. It is near impossible for most students to achieve a 50% savings rate for financial independence when technically their savings rates are negative because of endless student loans.

So, should you go to college if you want to become financially independent On average, you are better off going to college if you want to become financially independent, but it certainly isn’t a requirement and everyone’s situation is different.

To come to our conclusion we need to take some generalities and evaluate the numbers. Numbers do not lie, and although everyone’s situation will be different, we can use statistics to make our conclusions as accurate as possible.

Jump Ahead To:

How Much Will A College Degree Cost Me In Time And Money?

Think that it will take you 4 years in order to obtain a 4-year degree? Think again. On average it seems that you are more likely to obtain a degree in 6 years as opposed to 4 years. According to the National Center for Education Statistics (NCES) “The 6-year graduation rate (150 percent graduation rate) for first-time, full-time undergraduate students who began seeking a bachelor’s degree at a 4-year degree-granting institution in fall 2010 was 60 percent.” That means it took 60% of students that started in Fall 2010 to graduate in 2016.

If it is more likely to take you 6 years to graduate then guess what? That is two more years of high tuition that you will be paying and probably more student loans that you will need in order to get by. How much does tuition cost anyway? It varies of course based on the state and residency status of the college you will be attending. California has the highest population and the highest amount of colleges offered. Here are some different tuition costs in California according to CollegeCalc.org:

2019:

- California State University: $5,742

- University Of California: $11,502

- Harvey Mudd: $54,347 (Most Expensive College In California)

Not only do you have tuition to pay, but there is a load of different fees added onto the base tuition. It is more accurate to look at a “cost of attendance” page on a schools website where you will see a breakdown of the added on additional fees. Not to mention the ordinary living expenses that will occur as well. CompleteCollege.org gives us great visuals on data. One of those visuals is very striking. The average amount of student loan debt upon graduation is $30,100.

So not only do you (on average) pay so much for attending college, at the end of it all (usually 6 years) you will end up with $30,100 in debt. That’s not all, there is also the opportunity cost of those 6 years you spend not working full time. If you do work through college, more often than not it is very part-time and very low pay. If you could have been already in the game at a decent savings rate then you would be that much closer to financial independence. So it is not looking good for college so far. We have spent 6 years there and not we are $30,100 in debt. Let’s see if it pays off with a higher paying job.

How Much Will I Earn If I Do Go To College? How Long Till FI?

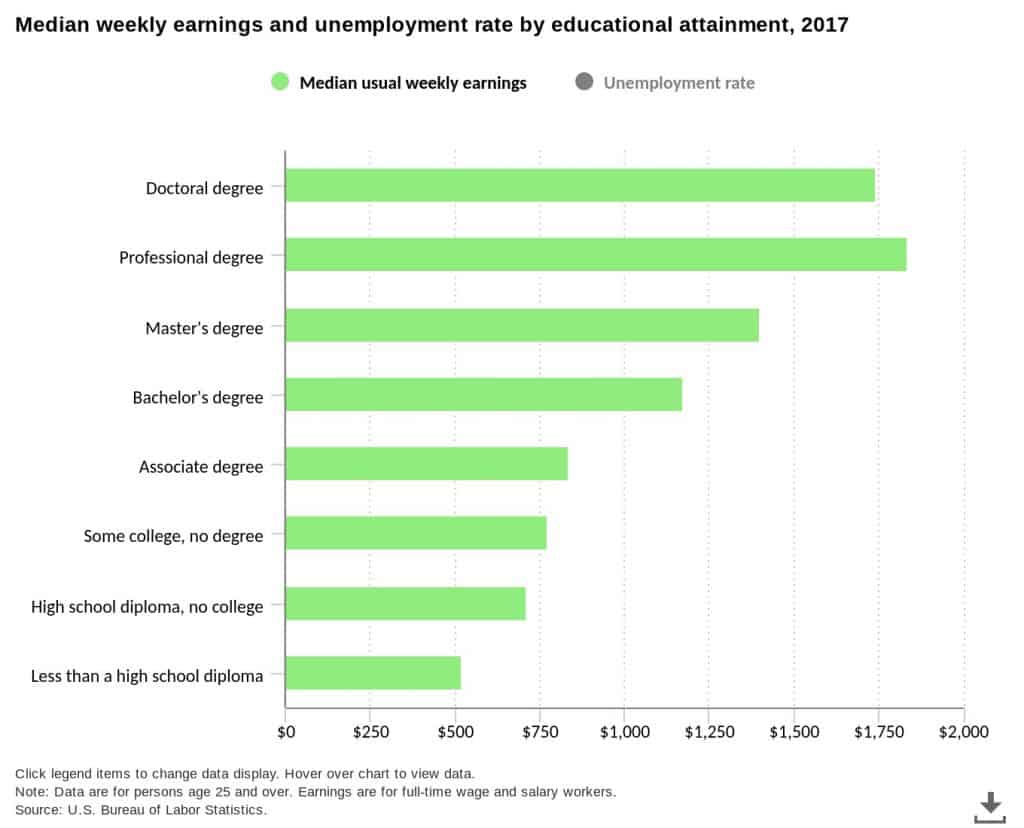

According to the Bureau of Labor Statistics (BLS) People with college degrees earn more money than people without them. I think we knew that already, but how much more? According to their data, the median weekly earnings of someone with a bachelor’s degree is $1,173 compared to a high school graduate with no college being $712. That is a difference of $416 per week. Over the course of a year or 52 weeks that is $21,632 more for a college degree based on these figures.

Your mileage may vary, perhaps drastically based on what kind of degree you got in college or what job you got out of high school, but based on these statistics, that is what you get: $21,632 more per year on average. Putting that into better perspective, the median college graduate makes $60,996 per year($1,173 x 52 = $60,996). The high school graduate makes $37,024($712 x 52 = $37,024). The difference is better seen now, and clearly in the long run over a 40+ year working career the college graduate would come out on top. What about for financial independence?

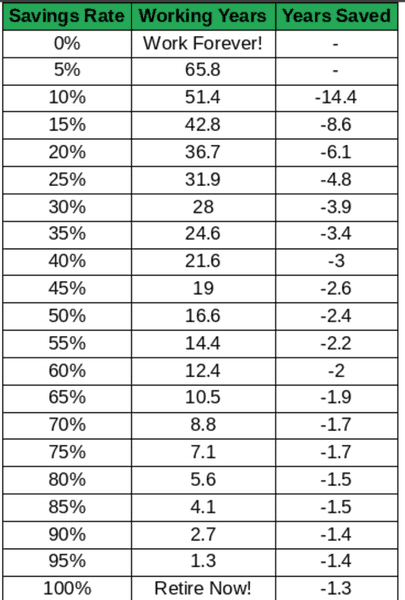

When we are striving for financial independence we aren’t looking at a 40+ year time frame. Most of the time we are looking for a 10-15 year time frame. In order to achieve financial independence in that time frame, you would need a savings rate of 55%-65% which I discuss in my post about the best savings rate for financial independence. We already know that college will set you back a bit because during college you will spend 6 years with pretty much a negative savings rate and come out of it with $30,100 in debt.

If you are reading this and are into financial independence then I have strong confidence that you would be better than the average so I will make a slightly different assumption for you. I will assume that you can graduate with a bachelor’s degree in 5 years instead of 6 and that you will have $25,000 in student loan debt but nothing else in investments yet. If you make the median income that the BLS gives us then how long should it take you to reach financial independence?

Your $25,000 in student loan debt is at 5% and we know that debt is an emergency. We also know that you make $60,996 per year or about $5,083 per month ($60,996 / 12 months = $5,083). As a motivated new graduate seeking to become financially independent as quickly as possible, you maintain a low cost of living “college life” and don’t allow your new income to inflate your lifestyle. You are able to achieve a 60% investment rate and live off of 40% of your income. This gives you about $3,050($5,083 x 60%) per month towards paying off your loans and then investing and $2,033($5,083 x 40%) per month for living expenses.

Using a student loan calculator from BankRate.com it will take about 9 months to pay off your student loan debt of $25,000 at a 5% interest rate. For simplicity and to be more realistic let’s say it takes 12 months to pay it off and you build up a small emergency fund (which I wrote about and do believe is important) with the other funds. After which you can begin investing the entire $3,050 into index funds and expect an 8% average return. 1 year after college you are at “ground zero” with $0 towards financial independence.

The journey towards financial independence should now take you about 12.4 years if you maintain a 60% savings rate and your income only keeps pace with inflation. In total with 5 years in college, 1 year to pay off student loan debt, and 12.4 years to reach financial independence it adds up to 18.4 years which we can easily adjust up to 19 years because things aren’t always perfect. If you are 18 when you went to college then your FI age will be 37 years old. Using this scenario and assumptions. How would it differ if you did not go to college?

How Much Could I Earn If I Don’t Go To College? How Long Till FI?

If you don’t attend college and you are able to earn the median income from the BLS (because you are smart) then you are making $37,024 per year or $3,058($37,024 / 12 months = $3,058) per month. You are reading this so you know about what it takes to become financially independent and the frugalness that is usually required. Your lower income prevents you from being able to achieve a 60% investment rate, but you do manage to do 45% which puts you at $1,376($3,058 x 45%) for investments and $1,682($3,058 x 55%) for spending.

You don’t have any student loans to pay off and if you followed the same spending and investment rate then that 45% investment rate should bring you financial independence in about 19 years according to the chart above. That is just about an even match with going to college. 19 years later you are still 37 when you reach financial independence. What is the difference? When you went to college you ended up achieving financial independence in the same timeframe but you had more to spend ($2,033 per month vs $1,682 per month) and therefore you would end up with a larger net worth. Certainly, the extra $351 per month in spending would probably lead to a more comfortable life. It is a 20.86% increase in spending. At these low levels, increases in spending tend to have an impact on the quality of life.

What Can We Take From This?

It would seem that going to college on average will have you better off for financial independence than not going to college. Although we could achieve it in a similar time frame with our assumptions and statistics, the college graduate had a much better quality of life during the journey because they were able to spend 20.86% more.

You could use college to get to financial independence much faster if you are able to pick a major that pays exceptionally well. Here are the 7 best college majors that I think are best for financial independence. On the flip side, you could make financial independence dreadfully slow if you go to college and rack up more student loan debt than average, take it slow and graduate in 6 years, and pick a college major that pays very poorly afterward.

If financial independence is your number one goal, it would seem that on average you should go to college, but everyone’s circumstances are different. Very different. What if you know that you can get a higher than average paying job right after high school? There are many what-ifs and what is best for you is to make some projections yourself based on your situation and interests. Not everyone will do better going to college and not everyone will do better staying away from college.

What Is Wrong With These Assumptions?

I assume that you start earning the median income of your education level as soon as possible. You might start out lower than the median, you might start out higher. The data is “for persons age 25 and older”.

I assume that you never see a pay increase except to equal inflation exactly and so your savings rate and spending rate never change over the 19 years.

I assume that you are able to live off of $2,033 per month for the college graduate and $1,682 per month for the high school graduate. This might not be possible where you live, although let me tell you it is possible in a lot of areas within the country.

I assume that you are single without a girlfriend, boyfriend, wife, husband, kids, etc. that would help or hurt your expenses and investment rate. Achieving financial independence is so much easier with two people than it is with one because expenses don’t go up very much with two people, but income can double.

There are probably many more things you can find wrong with the assumptions, but that might be the problem. Trying to find every reason why something won’t work is exactly why you will be right. Try to find every reason why something will work instead and 9 times out of 10 you will find a way to make it work. If you want something badly enough like financial independence then you can make it work with almost any situation. If not, then you have the power to change your situation.

Is There A Way I Can Get The Best Of Both Worlds?

I think that there is one way that you could speed up your way to financial independence without regular college. It is certain that you are going to need some kind of skill in order to earn an adequate amount of money to invest heavily. Learning a particular trade can set you up for less time in the classroom and more time on the job. Many have apprenticeships where you are paid while learning. Lots of trades start out with decent salaries and in many cases, you could branch off to work on your own easily. Things like electricians, plumbers, carpenters, Technicians, etc. Can be quite lucrative starting off and do not require 5 years and $30,000 of debt to get into.

Requirements for these skilled labor jobs vary from state to state and so one line of work might make sense over another depending on where you reside. These types of professions will always be in demand, especially by overworked and overpaid people who don’t have time to do it themselves. I do not believe that a degree automatically means higher pay, you must possess some kind of skill that is needed in the world and you will be compensated for it.

Conclusion

When looking at data from BLS about median pay, it would seem to make more sense to go to college on average in order to achieve financial independence more easily. Your individual situation ultimately determines what choice you should make. Try and run the numbers yourself to see what would be best for you. There are no blanket statements that can apply to everyone like “everyone needs to go to college”. Only you can gauge your individual situation and only you are responsible for making the decision that is best for you.