No, Coast FIRE is not about retiring near the ocean, but it is about retiring. With ever-increasing access to the internet, more and more people are able to learn about Financial Independence, and Retiring Early (FIRE) and that is a great thing. Along with that comes many different spinoffs or subsets of FIRE that develop from us adapting the concept to fit our own situations and ideals. One of those subsets you may have heard about is Coast FIRE. What is Coast FIRE? Is it a good FIRE concept to follow? I researched this concept in-depth and I want to lay out all of the information for you so that you can decide if you should pursue it or not.

What is Coast FIRE? Coast FIRE is a subset of traditional FIRE where the goal is to invest a large amount initially and let the compound interest grow the principal investment until it covers your expenses like traditional FIRE.

There is a simple calculator known as a compound interest calculator that you can use in order to estimate your Coast FIRE number. Coast FIRE is best known for being used for traditional retirement age, but it can be adapted to fit early retirement. Ask yourself some questions to see if this subset of financial independence would be right for you and your goals.

Jump Ahead To:

Coast FIRE Explained

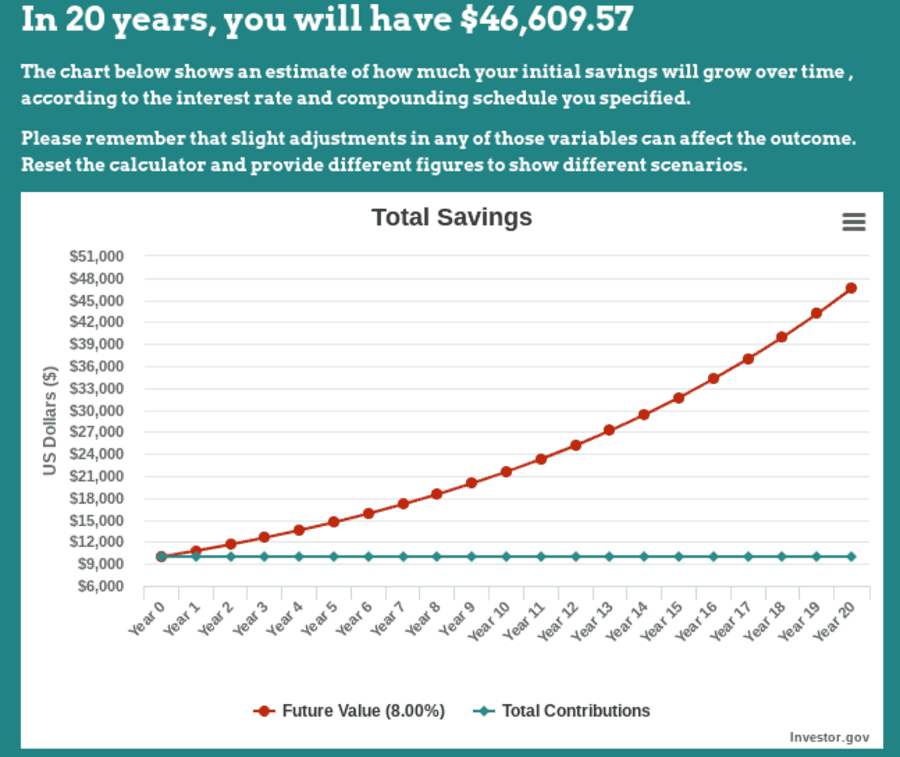

Coast FIRE on a base level just sounds like regular retirement, except that you are more prepared for it. A huge concept of coast FIRE is that it utilizes the power of compound interest to grow your wealth exponentially, especially over a long period of time. The longer compound interest has to work, the more powerful and exponential it would be. For example, if you invest $10,000 at age 20 earning an average rate of return of 8% compounded annually for 20 years then it would be worth approximately $46,609.57.

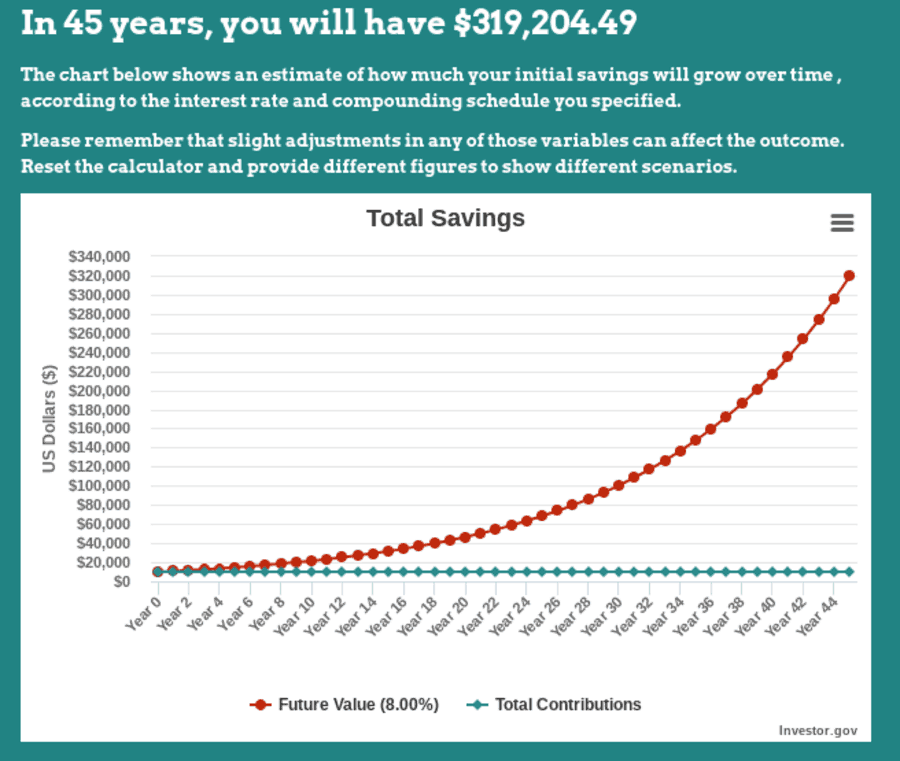

But if you invested that same $10,000 at age 20 and you didn’t touch it until traditional retirement age; we will say age 65 It would be worth a lot more. That is 45 years that the $10,000 has time to grow. Remember, you don’t invest any more money besides the initial $10,000 and it earns an average of 8% return for 45 years. You would now have $319,204.49 thanks to compound interest.

That is a pretty sizeable chunk to help you out in regular retirement, but it’s still probably not enough, and it doesn’t take inflation into account. A real Coast FIRE equation accounts for inflation so that you can estimate your purchasing power in “today’s dollars”. Still, isn’t it amazing how $10,000 can turn into $319,204.49 practically all on its own? Also, with coast FIRE, you don’t have to contribute to your investment accounts forever. Only initially at a younger age, perhaps when your bills and expenses are naturally lower anyway.

How To Calculate Coast FIRE

Now for the fun part; calculating Coast FIRE. Some ground rules for our calculation are:

- Once you reach retirement, you will be utilizing a 4% safe withdrawal.

- We will assume an 8% average return compounded annually before inflation.

- We will assume a 3% average rate of inflation.

- Once we reach our Coast FIRE number, we do not contribute any more.

- You are letting compound interest work for at least 30 years.

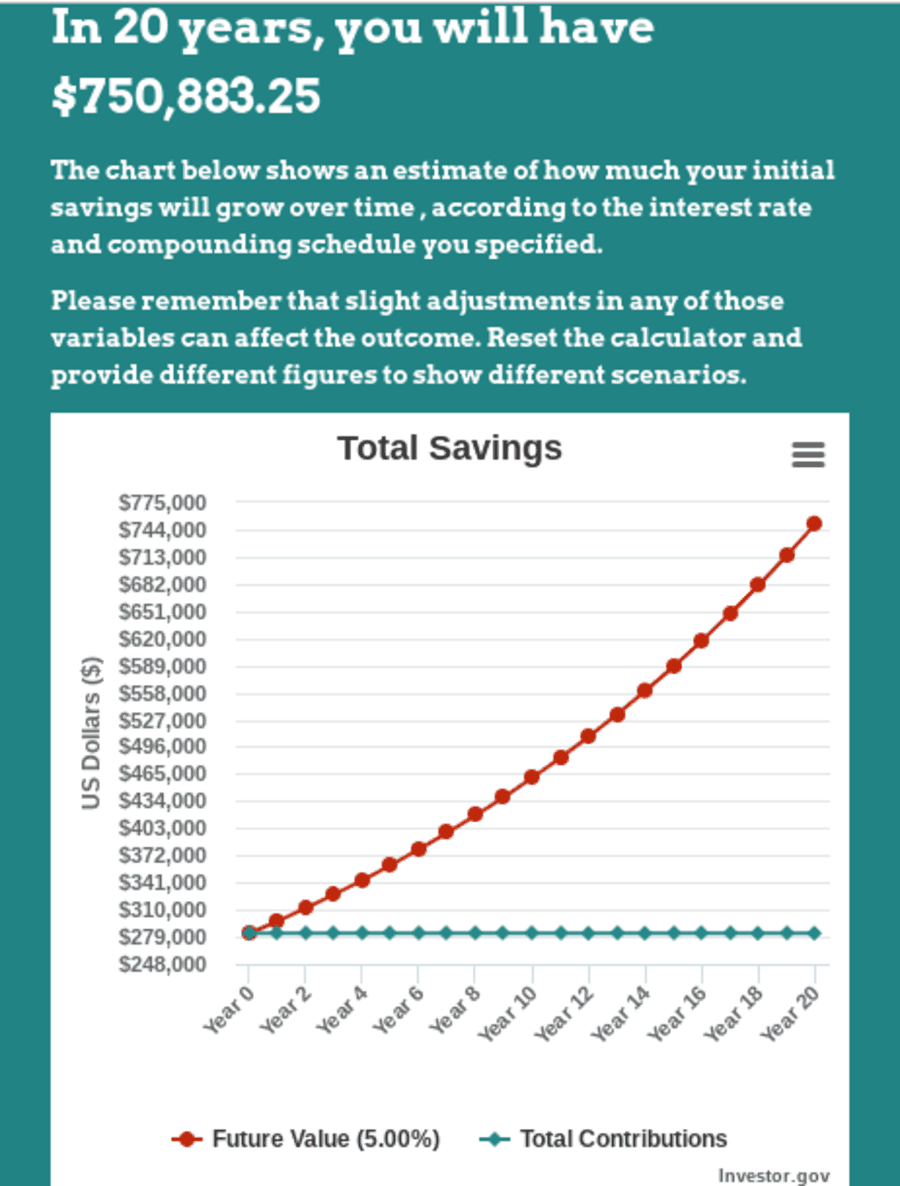

We will be utilizing a compound interest calculator to make it really easy for us. If we are using the 4% withdrawal rate, then we need to multiply the annual withdrawal we want to make by 25. For this example, we will want to spend $30,000 per year ($30,000 x 35 = $750,000) We would need $750,000 today in order to withdrawal $30,000 per year from it.

In order to account for the time value of money, we need to subtract inflation from our expected return on investment. With our assumptions in 1 and 2 this would be 8% – 3% = 5% real return. We will use 5% in our compound interest calculator.

It will take a little bit of playing around with, but what we want is a principal amount that gets us to at least $750,000 in 30 years. It only took me a few tries and I came up with about $170,000.

What this means is that if you were to invest up to a point where you had $170,000 when you were 30 years old, you would hit your Coast FIRE principal amount. You wouldn’t have to contribute any more for retirement, and the power of compound interest would grow that $170,000 into $750,000 in today’s dollars. The actual dollar amount would be more than $750,000, but if there was an average of 3% inflation per year then the dollar amount 30 years in the future would have the same purchasing power as $750,000 does today.

It’s a little tricky because no one knows what the average inflation rate would be over 30 years, or what your annual average rate of return will be, but estimation is the best thing we have to work with. The best thing you can do for your own Coast FIRE plan is to use conservative numbers and try to be as realistic as possible. Although coast FIRE is generally associated with traditional retirement ages, you can adapt it for early retirement, but it will require a lot more in savings.

Adapting Coast FIRE To Early Retirement

We just calculated that if you want to spend $30,000 a year 30 years from now then you would need $170,000 invested today in order to coast to retirement, but now we want to take a little more of an extreme approach and retire early using Coast FIRE. For that we need to list our new assumptions:

- You will still be utilizing a 4% safe withdrawal.

- We still assume an 8% average return compounded annually before inflation.

- We still assume a 3% average rate of inflation.

- Once we reach our Coast FIRE number, we will still not contribute any more.

- You are letting compound interest work for only 20 years now.

Really the only difference is that we have twenty years to coast for instead of 30, so it’s going to take a lot more principal until we coast because compound interest will have less time to do its magic. Plugging the numbers into the calculator gives me a principal requirement of about $283,000. A larger number than $170,000 by 60%. Would you want to figure out a way to save $113,000 more so that you can retire 10 years earlier?

Is Coast FIRE for you?

If traditional FIRE seems a bit too extreme for you then consider coast FIRE. In my opinion, Coast FIRE is a traditional retirement but done responsibly. All too often today people retire with next to nothing because they didn’t make an effort to save and invest through their working life. I can’t tell you if you should coast, only you can come to the conclusion of what you want to do for your retirement journey. Try to ask yourself some questions to see if coasting is right for you:

Are your expenses low enough right now to where you could take advantage of investing as much as possible right now?

Do you have a long horizon for when you want to retire?

Will you have other income streams when you retire?

Do you want to switch to a lower-paying, but more fulfilling career?

Is traditional FIRE unappealing to you?

Those questions should start igniting some thoughts in your mind to help decide if Coast FIRE could be for you.

For me personally, I got into financial independence in order to do it on a quicker scale than coasting would allow for, but I can see its appeal for those that just want a secure regular retirement. Or perhaps it could be a good fit for those that want to save a lot of money now while they are in a high paying career, and then transfer to a more enjoyable, but lower-paying career. It does sound great in theory to just see your principal grow and grow without you having to add to it, doesn’t it?

Conclusion

Coast FIRE is a great subset of FIRE for those that want a more traditional retirement or have a longer horizon. Coasting is all about utilizing the power of compound interest, and luckily for us, we have compound interest calculators that can aid us in our retirement plans. You can adapt Coast FIRE in order to retire early, but it will be a lot more difficult than using it for regular retirement ages. At the end of the day, you can weigh the pros and cons of Coast FIRE and decide for yourself if it might be right for you.