Financial independence requires a high savings rate if you want to achieve it in any reasonable amount of time. Your savings rate is one of the most important numbers you will deal with in your journey to financial independence, but what is the best savings rate? After all of my research, I have come up with a specific number.

So, what is the best savings rate for financial independence? The best savings rate for financial independence is 65% because it will get you to financial independence in about 10 years when starting from zero.

First things first, it is important to note that “savings rate” in financial independence does not mean putting money into a savings account, it really means “investment rate,” because savings are separate from investments. 10 years is a very good goal if you are starting from zero, if you are starting negative, then you might need a little bit longer, but financial independence can be mathematically based on your current income, expenses, and savings rate. Saving 65% of your income is no easy task, and it’s not possible for everyone, but If you can persevere then you will reap the ultimate benefit of financial independence and retiring early.

Financial independence can be mathematically based on your current income, expenses, and savings rate. Saving 65% of your income is no easy task, and it’s not possible for everyone, but If you can persevere then you will reap the ultimate benefit of financial independence and retiring early.

Jump Ahead To:

What “Savings Rate” Really Means For Financial Independence

When we talk about the savings rate for financial independence, what it really means is the investment rate. Proper Investing is an essential part of achieving financial independence. It doesn’t need to be risky or complicated thanks to the wonderful benefits of index fund investing. Index funds are the ultimate form of passive investments that provide passive income.

If you were to actually “save” 65% of your income into a typical savings account, that money would not be working very hard for you. You will most likely be receiving a paltry return on your investment. The average savings account offers you a whopping 0.1% according to Bankrate. Trying to completely save your way to financial independence simply won’t work in most circumstances. For one, savings are at the mercy of inflation and large savings lose purchasing power if the interest rate is less than the inflation rate, which is most likely the case.

Not only do you have inflation to worry about, but you also would have to worry about accumulating 25x your annual expenses all on your own. If you were to invest then your wealth is expected to not only outpace inflation, but the interest it earns will compound on itself and grow exponentially. When discussing how a 65% savings rate will allow you to retire in 10 years, there are usually certain assumptions that must be made.

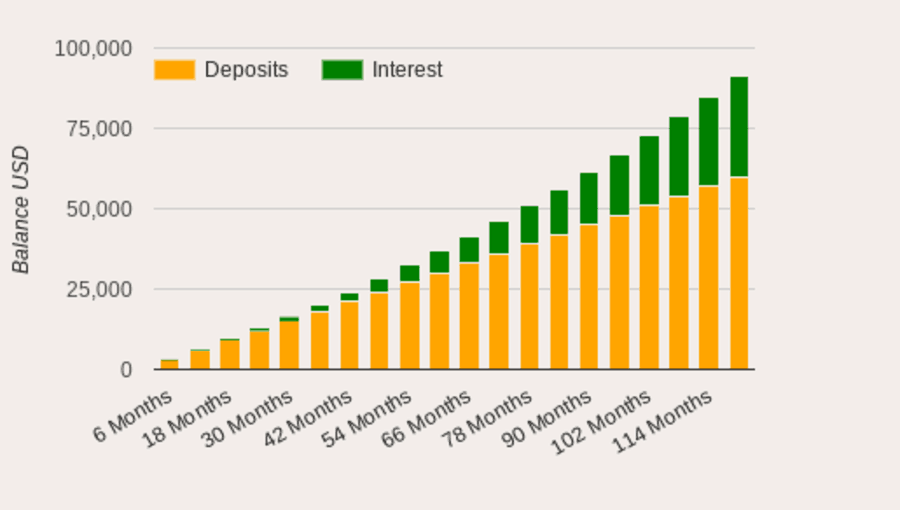

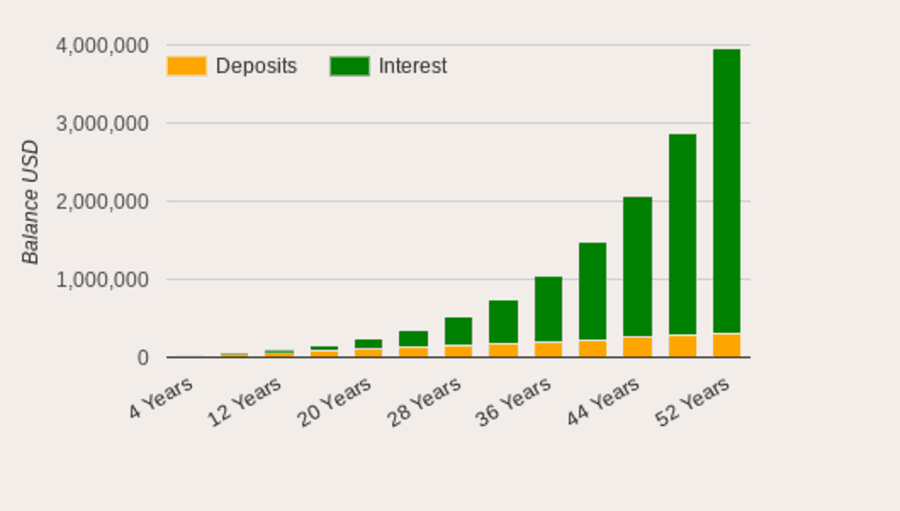

Compound interest is a powerful thing, although it won’t be very exponential over a 10 year period, it will over a longer period such as 50 years. The following two graphs show a starting balance of $0 with a $500 monthly investment growing at 8% per year. The first graph is a 10 year period which grows more linear. The second is over 50 years, which really shows the exponential power of compound interest.

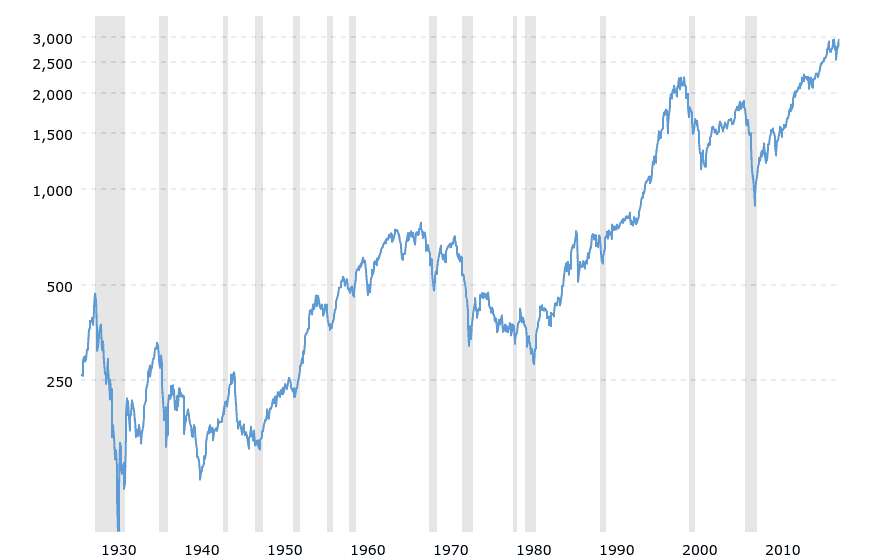

One of the most important assumptions is how much return on investment (ROI) you will receive on average from all the money you have invested. An 8% average return before inflation is standard practice for estimating how much index funds. So is a 3% average inflation rate, which will give you a real average return of 5%. The S&P 500 Index has actually returned closer to 10% since it’s inception according to Investopedia.

5% real return is an important number because for financial independence our safe withdrawal rate is 4% or less. This would mean that our principal is never touched in theory and would actually increase by 1% in purchasing power each year. These assumptions are pretty conservative, but no one can truly predict the future, and so it does have that 1% buffer built-in. So even though we say “savings rate” just remember it is actually an “investment rate”.

How Long You Should Take To Reach Financial Independence

I find 10 years to be the best amount of time to reach financial independence, why? Because 10 years is long enough to make the journey enjoyable, yet 10 years is short enough to make it worthwhile. 10 is also an easy number to remember, and a lot can happen in 10 years as well. If you are making a good income, then there should be little reason why you wouldn’t be able to reach a 65% savings rate if you really want financial independence.

10 years is a long term goal, but it is not long enough to where you would put it off. When a young person thinks of retiring it can be 30 or even 40 years down the line and a goal that far away is easy to forget and not focus on. 10 years is the perfect long term timeframe because it is near enough to envision, and it’s easy to count down to. How old will you be in 10 years, and can you imagine being free from the rat race at that age?

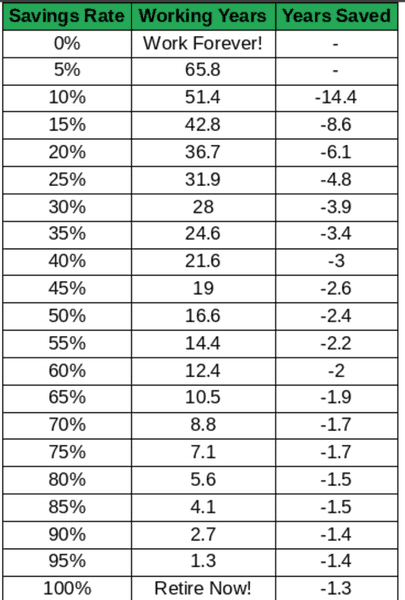

Financial independence is based on the savings rate for shorter time horizons and those savings rates will generate those time horizons for you. A 65% savings rate should generate around 10 years when starting from scratch. There is a diminishing return from increasing your savings rates, but I think 65% is a pretty good return. As you can see from the chart, 65% saves you 1.9 years compared to 60%. Whereas 10% saves you an entire 14.4 years from 5%. Both are 5% increases, but as your savings rates get higher, the marginal returns are diminished slightly each time.

How To Get To 65% And Beyond

So now that we have determined that 65% is the best savings rate, how do we get there? If a couple brings in a combined $100,000 after taxes then 65% of that would be $65,000 and the other 35% is $35,000. That is $35,000 to live on, which is very possible because a lot of people do it, but if your lifestyle has become highly inflated, it can be difficult to get down to that level again.

Everything counts in your savings rate, so every aspect of your personal finances needs to be scrutinized. The very first thing to do is to take a look at the big 3 expenses which are housing, transportation, and food. These big 3 expenses most likely make up a majority of your spending, just as it does for most people. These three categories usually take up at least 70% of your spending so it is. Here or some surface-level examples of how to optimize some of these expenses:

Housing

- Move to a lower cost of living area.

- Move to a neighborhood with lower property taxes.

- Downsize your home.

- Move a neighborhood without HOA’s.

- Rent out spare bedrooms on Airbnb for extra income.

- Refinance your mortgage for a lower interest rate.

- Get the best rate on home insurance.

- Get a roommate(s) to split rent and utilities.

- Use your utilities sparingly and minimize wastefulness.

Transportation

- Move closer to work and drive fewer miles.

- Downsize your vehicle.

- Drive a used vehicle.

- Never get an auto loan.

- Never lease a car.

- Never buy brand new cars.

- Consider going carless altogether if possible where you live.

- Carpool to work or other common destinations.

- Share one car instead of two as a couple.

- Get the best rate on car insurance.

- Get only as much car insurance as you actually need.

- Ride a bike or walk for closer destinations.

- Use public transportation.

- Use ride-sharing services.

Food

- Eat out less, cook at home more.

- Choose wisely when you do eat out.

- Make a shopping list and only buy what is on that list.

- Buy only enough groceries to where nothing will go to waste.

- Make fewer trips to the grocery store overall.

- Buy nonperishables in bulk sizes.

- Center your meals around cheap staples like rice, potatoes, pasta, etc.

- Eat less meat and cheaper cuts of meat.

- Buy generic brands instead of name brands.

Once you have figured out a way to optimize your big three expenses, you can begin tackling discretionary spending. Discretionary spending is pretty much everything that is not essential to survive. If it’s not food, water, or shelter then its technically optional. Either way, we do live in the real world and we do have expenses other than the essentials.

The easiest way to start looking at discretionary spending is to evaluate your monthly bills. What comes out of your account on the same day every month? You need to be aware of everything that gets charged to your accounts, and that’s a big reason why you should simplify your finances.

If you have monthly recurring charges and you have no idea what they are for then there’s an easy problem that needs to be fixed. If you have monthly recurring charges for something you never use or only used once then there’s another easy problem that needs to be fixed. Lastly, if you have monthly bills that you could really do without then that is something that needs to be fixed. A great example of that would be cable TV. Cable TV is very easy to live without because of the internet.

Now that the reoccurring expenses have been dealt with, you can look at the purchases you randomly make yourself. Try to identify any trends to see if you have created an artificial reoccurring expense and try to either eliminate it or optimize it. One example could be purchasing a coffee every morning from a coffee shop. You could break the habit, or you could make that coffee at home yourself every morning in order to save time and money. Another example could be eating out for lunch while at work. Simply bring your own lunch from home in order to optimize that habit.

After you have gone through all of your expenses, it may be time to slightly formalize it by creating a budget. A budget is just an estimation of monthly spending, and it keeps you accountable. The best way to implement a budget, in my opinion, is not to worry about individual category spending limits, but to worry about the overall total spending limit. For example, instead of worrying about spending $350 on groceries instead of your budgeted $300, worry about if your overall monthly spending has gone over your allotted $3,000.

This can be referred to as flexible budgeting because your budget can adjust month to month or even week to week. Some months you might spend less on groceries and more on car gas, and another month it might be the opposite. The point is to set monthly targets for your categories, but allow yourself to take away from one category and give to another category based on that particular month’s spending. As long as the overall budget amount is followed you will be able to meet your goals

Putting All The Steps Together

- Optimize the big 3 expenses: housing, transportation, and food.

- Scrutinize monthly recurring expenses and eliminate unnecessary ones.

- Identify trends in your spending and eliminate them or optimize them.

- Set up a flexible budget.

Following those four steps will get you a long way towards getting a 65% savings rate. You might not be able to attain that high level of savings just yet, but as you begin to scrutinize and optimize, you will naturally get closer and closer as you take into account what is more important to you. Most of the time if you are passionate about becoming financially independent then you will see more and more expenses that are not needed to make you happy.

Not everyone will be able to get to a 65% savings rate. Some people may only be able to get to 50% and that is okay, If you look at the chart you can see that it is approximately 16.6 more years of working. I would choose 16.6 years over a traditional retirement time frame of 45+ years any day of the week, and I think most other people would too. All of our journeys to financial independence are different, some of us want to achieve it in 10 years or less, some in 20 years or less, some more. The secret is that there is no best savings rate that will work for everyone, but the same steps can be followed by everyone to get them to achieve financial independence.

Conclusion

So there you have it, I think that a 65% savings rate is the best savings rate for financial independence because it will give you financial independence in approximately 10 years if you are starting from zero. You must invest smartly and diligently in order to get to financial independence, and at the same time, you must be in control of your spending. The journey to financial independence is all about optimization of everything, including your happiness along the way.