I have always wanted to know what the best way to become financially independent is, and I have spent a lot of time researching the subject. I have found lots of different answers because there are lots of different ways to achieve financial independence. I have however found some commonalities in my research and I want to share them here.

So, what is the best way to become financially independent? The best way to become financially independent is by carefully and diligently investing at least 65% of your take-home income in index funds by being frugal, staying out of debt, and avoiding lifestyle inflation.

The first thing to do is to define what exactly financial independence is and what it means to achieve it. Once you know what your goal is you must optimize your lifestyle to where you are able to live off of 35% of your take-home pay and invest the other 65% of it. This will require some frugality in order to achieve, you must also avoid lifestyle inflation and bad debt as much as possible.

Jump Ahead To:

What Is Financial Independence?

When you start with any goal the first thing you need to do is to define that goal. I like using the SMART goal system which is (Specific, Measurable, Attainable, Realistic, Time-bound). It is easy to hit all the requirements of a SMART goal with financial independence. It is a time tested proven system of structuring short term and long term goals, it sets you up for success.

A Specific goal is to have 25x your annual expenses invested in index funds. You can Measure your progress based on your current net worth. Whether it is Attainable is completely up to your individual situation, but anyone should be able to make it attainable for them with enough hard work and time. It is Realistic because there are many people that have done it before. Lastly, It is a Time-bound goal because you decide your time frame based on the amount of your income that you invest.

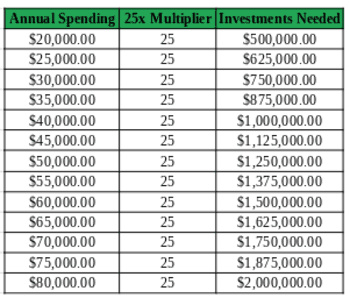

The best way to define financial independence as it relates to the best way to becoming financially independent is to attain a net worth large enough to where it is worth approximately 25x your annual expenses. So if your annual spending is $30,000 per year then you would need $750,000 ($30,000 x 25 = $750,000) invested to reach financial independence. If that spending level sounds low to you don’t worry, most people can get down to that level of spending and still live a very happy life, all it takes is lifestyle optimization, which is another important element of becoming financially independent. Here is a chart that shows various amounts of net worth needed for different spending levels you can see the the large differences as spending goes up, investments needed goes up x 25.

It is important to note that this net worth does not take into account your primary residence if you have one. Equity in a house is not included in determining if you have met the net worth requirement of 25x annual expenses unless you sell it and invest the profit. The significance of having 25x annual expenses is that you can withdrawal up to 4% of your net worth per year essentially without touching the principal. Your money has a very high probability of lasting you for the rest of your life and beyond.

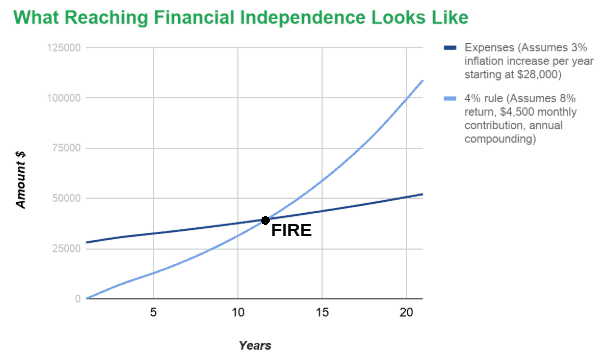

This 4% safe withdrawal rule is based on the Trinity Study, which concluded that ”withdrawal rates of 3% and 4% are extremely unlikely to exhaust any portfolio of stocks and bonds.” A lot of interpretation has been taken from the study and applied to early retirement. It is also important to note that it is assumed that you will never earn another dollar in your lifetime, which probably isn’t true for those of us seeking FIRE. Here is how reaching financial independence would look like on a very simplified chart:

At its core, being financially independent is not having to rely on financial support from work income. So many people are completely reliant on their jobs in order to support them, and losing a job is often catastrophic for someone and their family. Financial independence seeks to eliminate that scenario. Not being completely reliant on work income is the ultimate goal. If you reach the 4% rule then you (in theory) never have to rely on work income again. You can still work, you can still earn money, it is just the idea of not being 100% reliant on work income to survive.

There are many other ways to achieve this self-reliance as well. If you are able to build up enough sustainable passive income to replace your current spending then technically you are already financially independent. A common way of doing this would be with real estate rentals. Real estate can provide you with enough monthly cash flow to not have to work a regular job. Although not as passive as investing in index funds, they can be a viable way of generating enough passive income to replace your spending. Passive income takes many forms and has different levels of passiveness, but if you can find one you enjoy then you have already made it to financial independence in my eyes.

How To Invest 65% Of Your Income

In order to reach your goal of financial independence, you are going to need to invest a lot of money. Getting to a 65% investment rate is not an easy feat if you are not used to doing so. The best way to get financially independent requires regularly investing large sums of money consistently over some years. The fewer years you have to reach your goal the more you need to invest. If you are investing 65% of your income then that would mean that you are left to spend 35% of your income. If you want to maintain that level of spending after reaching financial independence then following the 4% safe withdrawal rule will get you there.

The question is how to get such a high investment rate. This can be done in a variety of ways. The most obvious would be to either increase income or decrease expenses and a combination of both is always the best. There are some ways that you can increase your investment rate by making some small but smart decisions. It is important to remember that your investment rate is based on your take-home pay, that is after taxes and deductions. Some deductions like medical, dental, insurance, etc. are still considered expenses. Others like 401k deductions are included in your investment rate.

Increase Income

Increasing your income is probably the first thing that many people think about when trying to reach financial independence faster. While it is a viable strategy, there is only so much that you can realistically increase your income without being overly drastic or risky. The goal for most people wanting financial independence is not to be rich, but to have “enough” to live well and be healthy. There are countless ways to increase your income, some of the best ones are listed below:

- Switch To A Higher Paying Job

- Get A Promotion At Your Current Job

- Strive For Bonuses And Incentives At Your Current Job

- Get A Second Part-Time Job

- Do Some “Side Hustling” (which are pretty much flexible part-time jobs)

- Optimize Your Taxes To Pay As Little As Possible Legally

- Take Advantage Of Free 401k Matches

- Move All If Your Liquid Cash Into High-Interest Savings Accounts

Decrease Expenses

Just like with increasing income, there is a reasonable limit to how much you can reduce expenses. You can probably smartly reduce them by a lot, however. The best way to go about it is to start with the big stuff and make your way down to the smaller stuff. Remember that the less your expenses are, the less you need in total wealth to become financially independent and therefore the faster you can achieve it. Here are the steps I would take when first starting to smartly decrease expenses:

- Start with optimizing the big 3 expenses I talk about them in more detail in this post.

- Eliminate unnecessary and recurring expenses that you hardly ever use (subscriptions).

- Look for patterns in your regular spending and try to reduce or eliminate bad habits.

- Scrutinize and track everything using online software like PersonalCapital.com

Why invest at 65%

I have determined 65% to be the perfect investment rate for financial independence because mathematically it should take you around 10-11 years to become financially independent if you start from 0. In fact, all of the savings rates can be mathematically estimated to give you a time frame towards achieving FI As I have discussed in my post here.

While 65% may seem like it is a tough goal to reach at first if you develop a different way of thinking towards money then I believe almost anyone can achieve it. You do not have to change everything overnight and go from a 5% savings rate to a 65% rate. It will take time and adjustments to your spending and your lifestyle in order to get to that level of investing. One important thing to remember that any money saved does not count towards the 65% rate. The 65% rate is exclusively for investments.

I myself have certainly not started with a 65% rate, while I have always known that I needed to invest as much as possible as soon as possible, I have worked my way up to it. My investment rate has fluctuated with the big changes in my life. I have done as high as 75% and as low as 20% when I first started. I now make it a priority to remain at or above 65% because it is the perfect combination for me. I think it is a good combination of investing and spending for many others that seek financial independence as well.

How To Be Frugal And Avoid Lifestyle Inflation

Being frugal is all about not being wasteful and getting the most value out of what you do have. If you have optimized your lifestyle, especially with the big 3 expenses then you should naturally avoid lifestyle inflation. It can be tricky sometimes if you have unexpected increases in income or big life events.

The biggest thing to look out for is unexpected increases in income. If you receive a bonus at work that you didn’t know about it could be tempting to go out and spend it to celebrate. After all, it is not included in your regular budget, right? Doing so will lead to lifestyle inflation. You will be training yourself to spend any amount of income that is above the ordinary and projected. This will lower your investment rate when instead you could have increased your investment rate and took advantage of a small step forward towards financial independence.

If you invest all of the bonus income then nothing else would have changed. You were going to live and be happy without it so why would you need to celebrate now when you could be celebrating in a few years when you are financially independent. In addition to bonus income, if you receive any monetary gifts or a regular pay raise, don’t let your level of spending inflate to the new level of income. There are two ways I believe to be best for handling pay increases or bonus income:

- Put all of the money into investments and enjoy no lifestyle inflation.

- Allocate extra spending based on your investment percentage. (Invest 65% Spend 35%)

The next biggest thing to look out for when it comes to lifestyle inflation is debt or creating new regular bills for yourself. Subscription services are one small but great example. These services offer you access to something at a monthly reoccurring cost. These services are so successful because once someone has access to something, even if they only use it sparingly, it is difficult to give up. It is natural for humans to not want to give up something once they have had access to it and enjoy it, even a little. The best way to prevent this is to avoid adding monthly subscriptions or any recurring “bills” as much as possible, only ones that you truly enjoy using and use regularly.

In addition to that, obtaining debt is another form of lifestyle inflation. Even if the interest rate is very favorable, it is best to avoid it as much as possible. On large purchases, it could be hard to give up a large sum of money because you see that money leave your hands today. Financing a purchase like a new car would seem to make financial sense since you can get a low-interest rate and probably make more money if you invested the difference. However this is a slippery slope and you must be careful, it is very tempting but it could lead you to think this way about a bunch of other large purchases and before you know it you have a large number of bills due against your low-interest debt.

Paying for larger purchases with your own money might not make financial sense if you can invest the difference and make more than what you are paying in interest, but this way of thinking may indirectly lead you to make more purchases on debt than you need. Paying with your own money will most certainly make you rethink a lot of purchases. Again, it is just natural for humans to behave this way because it is hard to visualize how much money we are giving up over time instead of just right in this moment.

I have a credit card that offers 0% interest on certain purchases for 6 months for certain items. It certainly makes more financial sense to pay off the larger items over 6 months at 0% interest than to give up all of my money at once. However, I know that If I used that service then I would make larger purchases more often. So I have avoided using that offer altogether. As a result, I don’t make very many large purchases because I would have to part with a lot of money at once and I usually deem it as not worth it.

Why Is This The Best Way To Become Financially Independent?

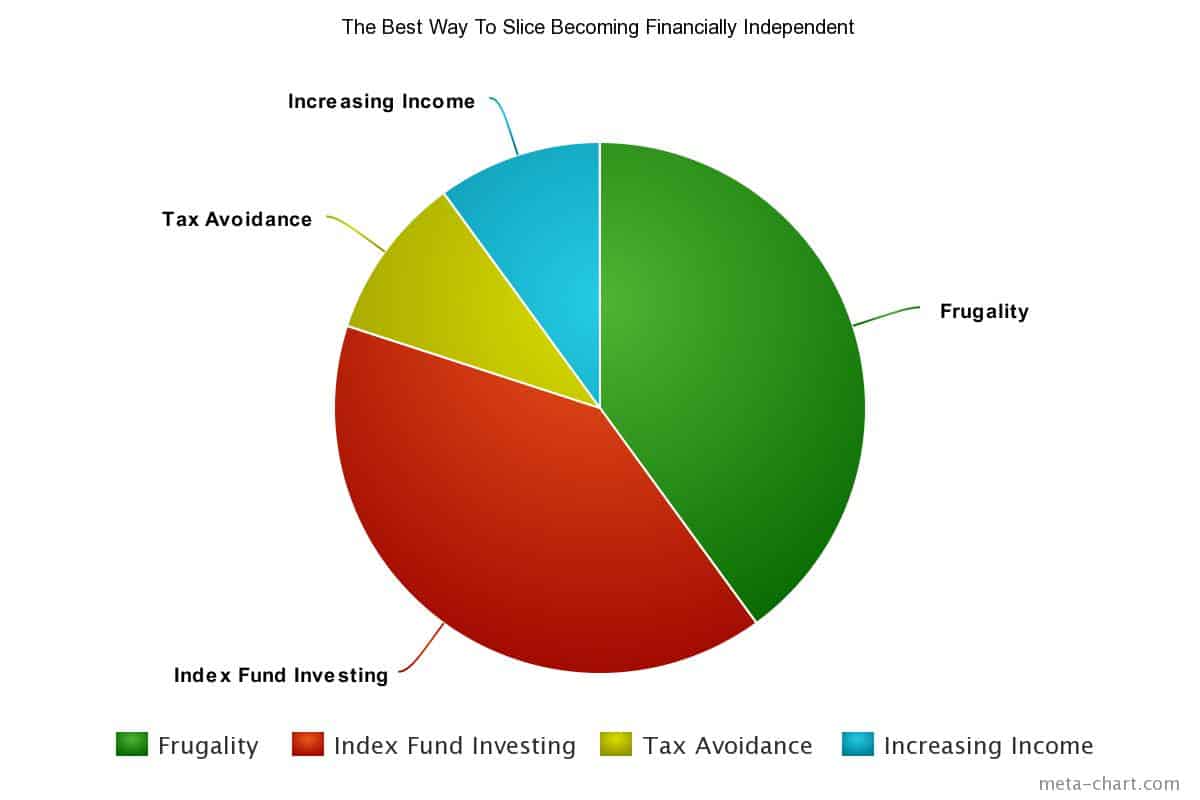

There are many different ways that you can become financially independent, what makes this way the best way? I believe that this method is actually the most promising. I believe that it offers a good return for little risk. This method can also be applicable to most people. The investments are easy and extremely passive.

Achieving a high investment rate is applicable to most people almost regardless of their income. Index funds are very passive investments that have historically offered great returns. They also come at very little cost to the investor. Most of them have no trade fees with online discount brokerage firms. They also have the lowest ongoing fees because they do not require active management. These fees are often around 0.05% which is the equivalent to $500 per year on a million dollar portfolio.

Index funds are an investment vehicle that is available to everyone, and today you can get started investing in them with very little principal. Before their invention, no individual investor could achieve the level of diversification that index funds offer. Diversification is extremely important for managing portfolio risk. In addition, index funds can also allow you to achieve balanced ratios of stocks to bonds with ease. I have never found a solid investment vehicle that fits the needs of nearly anyone like index funds do. For these reasons and many more, I believe that they are the best way to invest your way to financial independence.

Beyond investing, I believe it is important to be in control of your expenses as much as possible if you want to be financially independent. That is why sensible frugality is such an important factor. Not only does frugality allow you to be more in control, but it also allows you to reach your goals faster. For every $1,000 more you require in spending per year, you must have $25,000 (25x more) than that invested to be financially independent. Reducing expenses is a very powerful tool for financial independence.

The best things in life really are free, or at least they aren’t very expensive. If you really stop and think about some of the best moments in your life, they probably didn’t cost very much to have. The answer to that question usually relates to time with friends and family. It is sensibility that sets frugality apart from just being cheap. You need to divide up all the things that you spend time and money on and decide how much value you receive from them. Frugality focuses on those things which provide you with a high value per time and money spent. It takes a lot of discipline to follow this path, but the reward at the end is very much worth it.

Another important element of the best way to become financially independent is tax optimization. Take full advantage of legal tax incentives. There are a lot of them available to us that want to retire early and become financially independent. There are tax deductions, tax credits, and tax avoidance strategies that are expressly available to those of us that follow this method. Below is a visual pie chart of key elements of what you need to follow in order to achieve financial independence this way:

Conclusion

If you want to become financially independent, then I believe the best way is to diligently invest at least 65% of your income in index funds. Using this method you will develop frugal habits and you will see great returns with minimized risk. This investment strategy is also the most passive strategy. All of this can be achieved through various optimizations of your lifestyle, avoiding lifestyle inflation, and avoiding unnecessary debt.