Financial independence can be described as just a number at its very core. Although it is much more than that, it is something measurable that we can calculate. This calculation will be different for all of us, but the formula is basically the same. I have seen and read many different ways to calculate financial independence. I have found one calculation to be the most reoccurring and the one I use to plan for my own financial independence.

So, how do you calculate financial independence? In order to calculate financial independence, all you need to do is multiply your planned annual expenses by 25 to find your financial independence number. This number will allow you to follow the 4% safe withdrawal rate rule.

The 4% rule is the most highly touted way to plan for financial independence and retiring early. It is supposed to be enough money for your assets to last for your lifetime and beyond. There are a couple of different ways you can calculate your financial independence number but using planned expenses is the most accurate. There are many calculators that can give you great estimates and help you along the way, but they are just guesses and your results may vary.

Jump Ahead To:

What is the 4% safe withdrawal rule?

The 4% safe withdrawal rule is a rule of thumb used in the financial independence community to estimate what the maximum amount of money one can withdrawal from their assets each year while at least maintaining total assets purchasing power and principal. For example, if you have $1,000,000 in assets then you should safely be able to withdrawal $40,000 per year from your assets and your assets should last you a lifetime.

The whole idea is based on a study known as the Trinity study where they concluded that ”withdrawal rates of 3% and 4% are extremely unlikely to exhaust any portfolio of stocks and bonds.” It is also very important to mention that the study assumed that no money was ever earned once you started making withdrawals, which most likely isn’t true for the FIRE community. Basically, if you have a decent asset mix of stocks and bonds and take out less than 4% of your total assets per year then you have a very high probability of never running out of money. In fact, you have a probability of even growing your assets even more if your return on investments is high enough.

If you are withdrawing 4% of your assets per year and inflation is averaging 3% per year then you would need a return on investment (ROI) of at least 7% in order to technically maintain your asset base principal. Using $1,000,000, if it grew 7% in one year and you withdrew 4% then it would be 3% more which is $1,030,000. The purchasing power of that extra $30,000 is “only enough” to cover the rising cost of inflation, however. This brings up another important point; You could grow richer in theory even withdrawing 4% of your assets per year.

Let’s say that instead of 7% ROI you averaged a 10% ROI (which happens to be the S&P 500 average return since its inception according to Investopedia). All other factors were the same; you withdrew 4% and inflation was 3%. That would mean that your assets grew in purchasing power by 3%. You still got 3% richer overall. What if that increase in wealth allowed you to decrease your withdrawal rate and you maintained your lifestyle and didn’t inflate it.

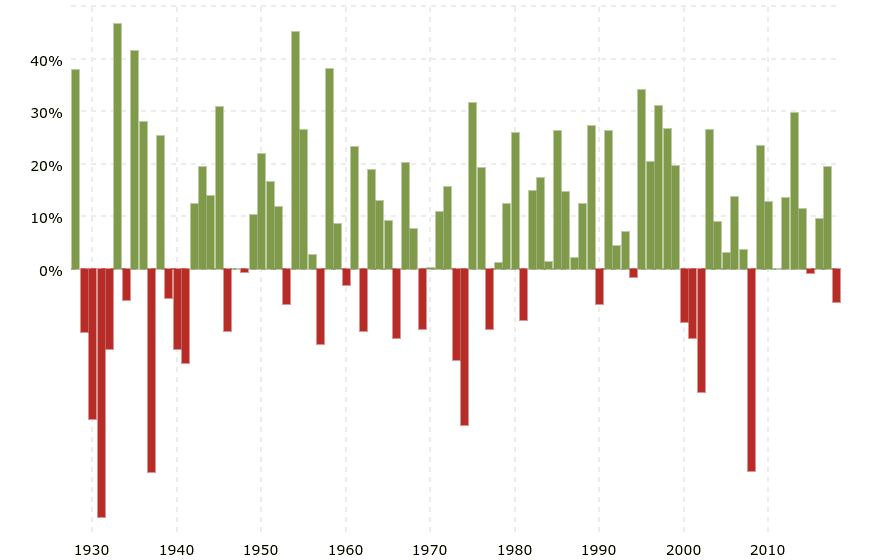

In theory, your assets would slowly grow more and more overtime even though you are financially independent and withdrawing from them each year. If only investments grew in a steady linear fashion. Unfortunately, they do not do that and they can be quite volatile. You can see below that even though the S&P 500 has returned 10% over its lifetime, it has been quite a bumpy ride. That is where proper diversification of stocks and bonds come in, but that is a whole nother story.

The important takeaway is that the 4% rule is very likely to work out in your favor. Even in tough times it usually has worked out. That is why my favorite calculator for financial independence uses simulations to estimate how many times you are successful while utilizing the 4% safe withdrawal rule. I will introduce that calculator very shortly. When we are invested for financial independence, we are investing for the long haul.

How to calculate your financial independence number

Your financial independence number can be calculated using a few very simple formulas. For more complex calculations and scenarios, we can use some of the fantastic financial independence calculators available to us for free. The two main ways to simply calculate our FI number are 1. Multiply our current/planned annual expenses by 25. Or 2. Divide our planned expenses by our planned withdrawal rate. These two simple calculations can help us find our overall investments needed to become financially independent.

- Multiply our current/planned annual expenses by 25.

This first method assumes that you will be using 4% as your withdrawal rate. By multiplying your annual expenses by 25 you are doing the reverse of calculating a 4% withdrawal rate. For example, if your current annual expenses are $40,000 then multiplying it by 25 will give you $1,000,000. By multiplying that $1,000,000 by 4% it will give you the $40,000. So if you spend $40,000 per year right now and maintain that when you become financially independent then you will need $1,000,000 in assets in order to become financially independent, your FI number is $1,000,000 in this case.

The formula is: (Annual expenses x 25 = FI number)

Example: ($40,000 x 25 = $1,000,000)

I prefer to use the planned expenses method instead of actual expenses because your FI goal could be different than your lifestyle right now. Maybe you know your expenses will drop in financial independence because you will move into a lower cost of living area, get rid of one of the cars, the kids will move out, you will eat out less, you will have fewer transportation expenses because you won’t commute to work, etc. There are a lot of reasons why your expenses will go down when you become financially independent. If you plan for that decrease in expenses then you could reach financial independence faster.

On the flip side, maybe you want to spend more when you reach financial independence than you do now. Maybe you want to travel a lot and stay in nice Airbnbs or maybe you would like to spend more on a hobby that you really enjoy but do not have the time to pursue right now while you are working. Whatever your motives are, I believe it is better to use planned expenses for determining your financial independence number if you believe your situation will change when you reach financial independence, which I think it will in most cases.

- Divide our planned annual expenses by our planned withdrawal rate.

You can still reach financial independence and not utilize a 4% withdrawal rate. There is no rule that says you must withdrawal 4% only. You can and maybe should withdrawal less if you can or want to. You could also theoretically withdraw more than 4% if you do not need your money to last as long as the 30 year-old retirees. I would always suggest 4% or less for continued wealth generation and economic downturns. The truth is we don’t know what the stock market or the economy will do tomorrow, a week from now, next month, next year, in 10 years, etc.

If you want to plan for a lower withdrawal rate, say 3% then multiplying your annual current/planned expenses won’t quite work for your situation. Instead what you should do is divide your annual expenses by your planned withdrawal rate and see your FI number. So if I plan for annual expenses of $36,000 in FI and multiply it by my goal withdrawal rate of 3% I will get $1,200,000.

The formula is: FI number = (planned annual expenses ÷ goal withdrawal rate) x 100

Example: $1,200,000 = ($36,000 ÷ 3) x 100

With this formula, you can test out different withdrawal rates and how large of a FI number you will need. If you are withdrawing 3% instead of 4% of your assets then your assets have an opportunity to grow 1% more. If that is important to you then maybe a withdrawal rate of less than 4% will work for you. If you just want your money to last your lifetime and maintain its power against inflation then a 4% rule is more than likely to bring you success. If we want more advanced calculations we can utilize some great free calculators designed just for financial independence.

What is the best calculator for calculating financial independence?

My favorite calculator for financial independence is hands down the FireCalc. This calculator uses historical data and runs simulations to see how many scenarios would have turned out in your favor or not. Utilizing the 4% safe withdrawal rate and having proper asset allocation usually tends to give you the best odds. Play around with the calculator and try to see if your financial independence plan is likely to succeed or doomed to fail. Don’t forget to utilize the different tabs on the top menu bar.

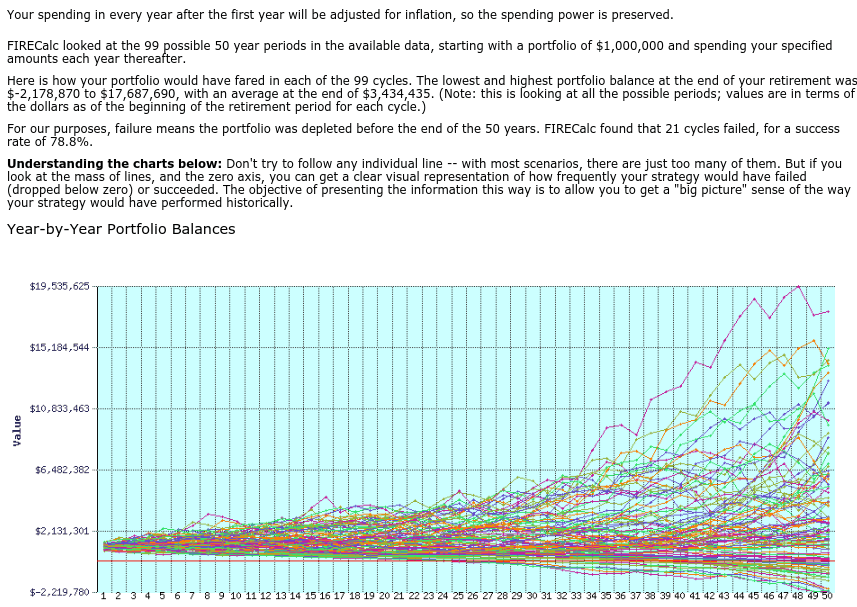

In my calculated scenario below I utilize a 4% withdrawal rate for a 50-year retirement and found success of it lasting me the entire 50 years 78.8% of the time. I also assumed no social security and no pensions in the future. I used “constant spending power” which means I didn’t spend less even when my portfolio dropped significantly dues to market downturn (highly unlikely anyone would do this). I used the default 75% stock 25% bond asset allocation. This calculation also means I never earned another penny along the way in 50 years (also highly unlikely).

You can utilize this calculator to make your own assumptions. I used pretty much the worst-case scenarios and still ended up succeeding 78.8% of the time with a 4% withdrawal rate. The odds are that you will earn some money in the next 50 years which will increase your odds of success dramatically. Additionally, the odds are that you will reduce your spending a little bit if your portfolio takes a temporary dive. The take away is that the 4% safe withdrawal rate should work, nothing is guaranteed, but odds are that you will come out on top.

How reliable are the calculations?

No calculation of the future is going to be 100% accurate. The past does not determine the future, but it is the only thing that we have. The more assumptions you make, the closer you will probably be to being very close to being correct. Reliable data is the closest thing we have to predict the future, even so, we shouldn’t be too concerned with failure using the 4% rule because there is a lot of conservative thought behind it. Read the about page on the calculator site for more details on how it works and what makes it so great.

Conclusion

You can multiply your planned annual expenses by 25 to find your FI number, this is the best way to calculate financial independence. The 4% safe withdrawal rate gives you a very high probability of success in being financially independent for life. You can use calculators to further predict your success and develop a game plan for achieving your goals.