If you are seeking financial independence then you are probably seeking ways to optimize all of your expenses. Car insurance is one of the expenses you have because the law says so. Those of us in the FIRE community need to look at our insurance needs in very different ways compared to the general population.

So, how much car insurance do you need for financial independence? If you are seeking financial independence then you should only need liability and property car insurance in order to protect your assets.

There are lots of different types of car insurance, and it can be pretty confusing. Educate yourself on the different types and make an educated decision on how much car insurance you need for your situation. Protecting your assets is the number one goal of having car insurance for us seeking FIRE because we tend to have much higher net worths than the average person. The amount of car insurance you need is heavily dependent on what kind of car you drive, and there are smart choices you can make for FIRE when it comes to what you drive.

Jump Ahead To:

What Are The Different Types Of Car Insurance?

There are so many different types of insurances out there. Most of them are made up just to get some money out of you. Car insurance has its own plethora of options to choose from. I wouldn’t get your car insurance advice from an insurance agent. It is their job to get you to purchase as much insurance as possible. Mathematically, insurance companies are winners and we are the losers. They make heavy profits because they consistently gather big data and analyze it in order to set a rate tailored to you. That being said the primary types of car insurance are:

Liability Insurance: This covers bodily harm you have inflicted on others.

Property Insurance: This covers property damage you have inflicted on others.

Collision Insurance: This covers damage to your car from others or from yourself.

Medical: This is a payout for medical payments for yourself or anyone involved.

Uninsured/Under-Insured Motorist: This covers bodily harm to yourself if the other motorist has no insurance or less insurance than this amount.

Uninsured/Under-insured Motorist Property: This covers property damage to your property if the other motorist has no insurance or less insurance than this amount.

Comprehensive Insurance: This covers other things like theft, vandalism, fire, natural disasters, falling objects, etc.

In my opinion, if you are concerned about optimizing your car insurance for FIRE, I think you only really need liability insurance and property insurance. The insurance industry thrives on fear and “what ifs” so they will try to convince you that you need all of the above. If you make some other smart decisions then you could easily “get away” with just liability and property coverage.

How Much Car Insurance Is Needed For FIRE?

The generic advice on this is enough to car insurance equal to your assets. It is decent advice in my opinion but I think that it just depends on so many factors. If you are optimizing your car expenses then you should be limiting how much you drive anyway since transportation is one of the big 3 expenses. The less you drive, the less chance of an accident you will have. This isn’t always possible because some of us drive a lot of miles every year (myself included).

My suggestions would be to get quotes on the insurance to see how much your premium increases with each additional coverage increase. If you have a good record then liability and property insurance are pretty cheap anyway. I am pretty young so my insurance tends to be higher, but even with the max $100,000 in property insurance, the cost to me is $20 per month based on a 6-month premium. Liability insurance is pretty cheap as well, especially the increases in coverage. I can get my instant quote online. Changing my insurance from $100,000 / $200,000 to $100,000 / $300,000 costs me just an additional $1 per month. The choice is obvious to me.

Look at your own situation based on your own risk factors like how much you drive and make your decision. Look at the additional cost to increase your coverage. Often it is a measly few dollars for liability and property coverage. Weigh out the cost to benefit. In my last example, I got $100,000 in coverage for an additional $1 per month. That benefit is worth it to me. Do the math and apply it to your situation. You can plug extra costs into a compound interest calculator to determine if the additional monthly cost is worth it or if you should save for it yourself. Often, purchasing more liability and property car insurance is better if you have a good driving record.

Here is an example using actual figures from my online quotes:

In California, you are required to have $15,000/$30,000 in liability insurance and $5,000 in property insurance. If I used the minimums they would cost me as follows:

Liability ($15,000/$30,000): $117.80 / 6 months = $19.63 per month.

Property ($15,000): $98.70 / 6 months = $16.45 per month.

If I increase the coverage to the max allowed online these are my new costs:

Liability ($1,000,000/$1,000,000): $231.90 / 6 months = $38.65 per month.

Property ($100,000): $124.60 / 6 months = $20.76 per month.

So for me, It costs $19.02 per month for an extra $970,000 of liability insurance and an extra $4.31 per month for an extra $95,000 of property insurance. Are these extra costs worth the extra coverage? They are to me at the moment. I believe that I am at a higher risk of an accident where I drive and how much I drive, even though I know that I am a defensive driver. They are called “accidents” after all.

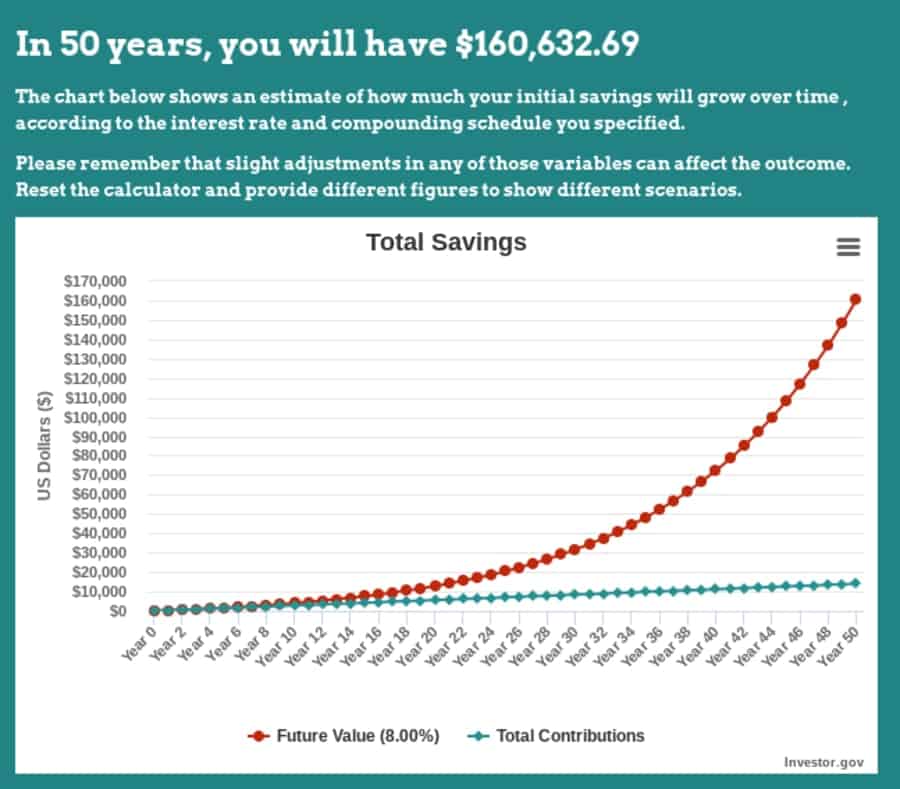

If I instead invested the $23.33 per month and earned an average 8% return per year then after 50 years I would have an extra $160,632.69. A lot can happen in 50 years and sadly, the odds are that I will be in at least one accident in that time frame. If I am at fault then The payout will probably be more than I would have saved instead. While I do hate insurance, $23.33 is an amount I am willing to give up in order to protect my assets in an accident where I am at fault.

So while how much car insurance is needed is very dependent on your situation. If you are concerned with FIRE then your number one goal should be to protect your assets. In my case, $23.33 per month will protect all of my assets in case I am at fault in an accident and I deem it a fair trade. Other types of car insurance I think aren’t necessary and you should be self-insured based on the type of vehicle you will be driving and your own health insurance.

Smart Choices To Reduce Car Insurance Costs

Ideally, we wouldn’t be driving cars at all. They are very dangerous and very costly, but it can be hard to give them up. I haven’t given them up, and I bet most of you haven’t either. Usually, we will still have our cars, but there are some smart choices we can make to reduce our car expenses and thus reduce our car insurance costs.

The first thing you should be doing is driving older lower cost cars. Cars that are valued at $10,000 and under are a good price point. Driving one that has a record of reliability is key to keeping expenses lower. Driving a car of this value will make it to where you can self insure the car itself. If the worst case scenario were to happen and your car is totaled, then you can replace it yourself. This is a luxury that those of us in the FIRE community have because of our accumulated assets. $10,000 will not break us like it would most people.

Right off the bat, we can get rid of the need for collision insurance and comprehensive insurance because we will pay for repair or replacement of our vehicles. In addition, we are already paying for good health insurance and do not need medical coverage from our car insurance company. Uninsured liability/property is probably the subject of more debate but we don’t care about the uninsured property because we have enough investments to replace our entire car in an unlikely event. Our medical insurance should cover uninsured liability as well, but this probably the toughest to answer. It really is dependent on your unique situation and medical insurance coverage.

With all of that being said, we are left with only covering our own liability. If we are responsible for the bills then we would rather use insurance than our own assets for such large bills like medical payments. When it comes to our own car, they are cheap <$10,000 and we could replace the entire car no problem. Sure, it would suck to give up $10,000 but in most cases, it makes much more mathematical sense to pay for repairs and replacement yourself on a low-cost vehicle than to have it insured. Of course, the rules differ if you are driving a brand new luxury vehicle.

Here are some additional small tips to save on car insurance:

- Don’t get car loans because they require you to have “full coverage”. Pay in cash.

- Don’t drive expensive vehicles, they are more expensive to insure.

- Ensure your medical insurance covers automobile accidents.

- Shop around for insurance each time your policy is up to renew.

- Pay your premiums in advance as much as possible for maximum discounts.

- Look for extra discounts offered such as a good driver discount, good grades discount, bundled insurance discount, etc.

Conclusion

For those of us in the FIRE community, we should only really need liability insurance and property insurance in order to protect our assets if we are at fault in a car accident. We should be driving vehicles that we can afford to easily pay for repairs or replacement of the vehicle. Always maintain at least the state minimum obviously but don’t be afraid to go for the maximums in liability and property insurance because they are often very low cost if you have a good driving record. You should have good medical insurance that will pay for injuries occurred by you or your family. At the end of the day, how much car insurance you need is heavily dependent on individual circumstances and risk tolerance. So there is no one way that will work for everyone, these are just the suggestions that I make based on FIRE principles.